|

Carlyle - The Octopus

Portfolio

|

|

Carlyle is a unique model, assembled at the planetary level on the capitalism of relationships or "capitalism of access"

|

Investing in War

The Carlyle Empire

By ERIC LESER

The biggest private investor in the world, deeply entrenched in the weapons' sector, is a discreet group that cultivates dealings with influential men, including Bush father and son.

One year ago, May 1, 2003, George Bush, strapped up in a fighter pilot's suit, landed on the deck of the aircraft carrier USS Abraham-Lincoln along the coast of California. The image became famous. Under a banner proclaiming "Mission Accomplished", the president prematurely announced the end of military operations in Iraq and his victory. Back on dry land the next day, he made another martial speech, not far from San Diego, in a United Defense Industries' weapons factory.

This company is one of the Pentagon's main suppliers. It manufactures, among other things, missiles, transport vehicles, and the light Bradley armored vehicle. Its main shareholder is the biggest private investor in the world, a discreet group, called Carlyle.

It's not listed on the stock market and doesn't have to show its accounts to any but its 550 investors- billionaires or pension funds. Carlyle manages eighteen billion dollars today, invested in defense and high tech (notably biotech), space, security-linked information technology, nanotechnologies, and telecommunications. The companies it controls share the characteristic that their main customers are governments and administrations. As the company wrote in its brochure: "We invest in the opportunities created in industries strongly affected by changes in government policy."

Carlyle is a unique model, assembled at the planetary level on the capitalism of relationships or "capitalism of access" to use the 1993 expression of the American magazine New Republic. Today, in spite of its denials, the group incarnates the "military-industrial complex" against which Republican President Dwight Eisenhower warned the American people when he left office in 1961.

That didn't prevent George Bush senior from occupying a position as consultant to Carlyle for the ten years ending October 2003. It was the first time in United States' history that a former president worked for a Pentagon supplier. His son, George W. Bush, also knows Carlyle well. The group found him a job in February 1990, while his father occupied the White House: administrator for Caterair, a Texas company specialized in aerial catering. The episode does not figure in the president's official biography. When George W. Bush left Caterair in 1994, before becoming Governor of Texas, the company was in bad shape.

"It's not possible to get closer to the administration than Carlyle is," asserts Charles Lewis, Director of the Center for Public Integrity, a non-partisan organization in Washington. "George Bush senior earned money from private interests that worked for the government of which his son was president. You could even say that the president could one day profit financially, through his father's investments, from the political decisions he himself took," he adds.

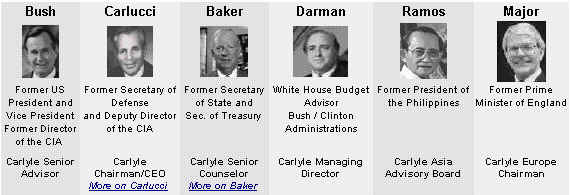

The collection of influential characters who now work, have worked, or have invested in the group would make the most convinced conspiracy theorists incredulous. They include among others, John Major, former British Prime Minister; Fidel Ramos, former Philippines President; Park Tae Joon, former South Korean Prime Minister; Saudi Prince Al-Walid; Colin Powell, the present Secretary of State; James Baker III, former Secretary of State; Caspar Weinberger, former Defense Secretary; Richard Darman, former White House Budget Director; the billionaire George Soros, and even some bin Laden family members. You can add Alice Albright, daughter of Madeleine Albright, former Secretary of State; Arthur Lewitt, former SEC head; William Kennard, former head of the FCC, to this list. Finally, add in the Europeans: Karl Otto Poehl, former Bundesbank president; the now-deceased Henri Martre, who was president of Aerospatiale; and Etienne Davignon, former president of the Belgian Generale Holding Company.

Carlyle isn't only a collection of power people. It maintains holdings in close to 200 companies and, above all, provides returns on its investments that have exceeded 30% for a decade. "Compared to the five hundred people we employ in the world, the number of former statesmen is quite small, a dozen at most," explains Christopher Ullmann, Carlyle Vice-President for communication. "We're accused of every wrong, but no one has ever brought proof of any kind of misappropriation. No legal proceeding has ever been brought against us. We're a handy target for whoever wants to take shots at the American government and the president."

Carlyle was created in 1987 in the salons of the New York eponymous palace, with five million dollars. Its founders, four lawyers, including David Rubenstein (a former Jimmy Carter advisor), had the -limited- ambition at the time of profiting from a flaw in fiscal legislation that authorized companies owned by Eskimos in Alaska to give their losses to profitable companies that would thus pay reduced taxes. The group vegetated until January 1989 and the arrival at its helm of the man who would invent the Carlyle system, Frank Carlucci.

Former Assistant Director of the CIA, National Security Advisor, then Ronald Reagan's Defense Secretary, Mr. Carlucci counted in Washington. He is one of current Defense Secretary Donald Rumsfeld's closest friends. They were roommates as students at Princeton together. Later, their paths crossed in several administrations and they even worked for a time at the same company, Sears Roebuck.

Six days after officially quitting the Pentagon, January 6, 1989, Frank Carlucci became Carlyle's Director General. He brought trusted lieutenants from the CIA, the State Department, and the Defense Department with him. Nicknamed "Mr. Clean", Frank Carlucci has a sulfurous reputation.

This diplomat was posted during the 1970s to countries such as South Africa, the Congo, Tanzania, and Portugal, where the United States and the CIA had played a questionable political role. He was the number two at the American embassy in the Belgian Congo in 1961 and was suspected of being implicated in the assassination of Patrice Lumumba. He has always firmly denied it. The American press has also accused him of being implicated in several cases of arms trafficking in the 1980s, but he has never been prosecuted. For a while, he directed Wackenhut, a security company with a hateful reputation, implicated in one of the biggest espionage scandals ever, the hijacking of Promise software. Frank Carlucci had the mission of cleaning up after the Iran-Contra affair in the Reagan administration and he succeeded John Pointdexter as National Security Advisor. As he took over his new position, he chose a young general to be his assistant... Colin Powell.

Frank Carlucci's name attracted capital to Carlyle. In October 1990, the group took over BDM International, which participated in the "Star Wars" Program and constituted a bridgehead to it. In 1992, Frank Carlucci allied himself with the French group Thomson-CSF to take over LTV's aerospace division. The operation failed, Congress opposing the sale to a foreign group. Carlyle found other associates, Loral and Northrop, and got hold of LTV Aerospace, quickly renamed Vought Aircraft, which contributed to the manufacture of the B1 and B2 bombers.

At the same time, the fund was multiplying its strategic acquisitions, such as Magnavox Electronic Systems, a pioneer in radar imagery, and DGE, which owns the technology for cruise missile electronic relief maps.

Three companies specializing in nuclear, chemical, and biological decontamination (Magnetek, IT Group and EG & G Technical Services) followed. Then, through BDM International, a firm linked to the CIA, Carlyle acquired Vinnell, which was among the first companies to supply the American army and its allies with private contractors, i.e., mercenaries. Vinnell's mercenaries train the Saudi armed forces and protect King Fahd. During the first Gulf War, they fought alongside Saudi troops. In 1997, Carlyle sold BDM and Vinnell, which had become too dangerous. The group didn't need it any more. It had become the Pentagon's eleventh biggest supplier by gaining control of United Defense Industries that same year.

Carlyle emerged from the shadows in spite of itself on September 11, 2001. That day, the group had organized a meeting at Washington's Ritz Carlton Hotel with five hundred of its largest investors. Frank Carlucci and James Baker III played masters of ceremony. George Bush senior made a lightning appearance at the beginning of the day. The presentation was quickly interrupted, but one detail escaped no one. One of the guests wore the name bin Laden on his badge. It was Shafiq bin Laden, one of Osama's many brothers. The American media discovered Carlyle. One journalist, Dan Briody, wrote a book about the group's hidden side, "The Iron Triangle", and takes an interest in the close relations between the Bush clan and the Saudi leadership.

Some ask about George Bush senior's influence on American foreign policy.

In January 2001, while George Bush junior was breaking off negotiations over missiles with North Korea, the dismayed South Koreans intervened with his father. Carlyle has important interests in Seoul. In June 2001, Washington resumed discussions with Pyongyang.

Another example: in July 2001, according to the New York Times, George Bush senior telephoned Saudi Prince Abdullah who was unhappy with the positions the president took on the Israeli-Palestinian conflict. George Bush senior reassured the prince that his son "is doing good things" and "has his heart in the right place."

Larry Klayman, Director of Judicial Watch, a resolutely conservative organization, demands that "the president's father resign from Carlyle. The group has conflicts of interest that can create problems for American foreign policy." Finally, in October 2003, George Bush senior leaves Carlyle, officially because he's nearing eighty years old.

It doesn't matter that Carlyle put an end to all relations with the bin Laden family in October 2001; the evil was already done. The group, along with Halliburton, has become the target of Bush administration opponents.

"Carlyle has replaced the Trilateral Commission in conspiracy theories," David Rubenstein acknowledged in a 2003 Washington Post interview. For the first time, the group put someone in charge of communications and changed its boss. Frank Carlucci became honorary president and Lou Gerstner, a respected executive who saved IBM, officially took the reins.

That operation seems mostly cosmetic. Mr. Gerstner doesn't spend much time in his office; but Carlyle wants to become respectable.

The Group has created an Internet site. It has opened certain funds to investors bringing "only" 250,000 dollars (210,000 euros). It will have reduced its holdings in United Defense Industries, and asserts that defense and aeronautics represent no more than 15% of its investments.

However, Carlyle continues to make intensive use of fiscal havens and it's difficult to know the names of the companies it controls or its perimeter.

Carlyle is also increasing its efforts in Europe. In September 2001, it took control of the Swedish weapons manufacturer Bofors through United Defense. Subsequently, it tried, unsuccessfully, to take over Thales Information Systems and, in the beginning of 2003, to acquire those parts of France Telecom that are in Eutelsat, which plays an important role in the European Positioning System by Galileo satellite--a competitor of the American GPS. From 1999 to 2002, it managed a holding in Le Figaro. In Italy, it made a breakthrough, by taking up Fiat's aeronautics subsidiary, Fiat Avio. This company is a supplier to Arianespace and allows Carlyle to be part of the European Rocket Council. In another coup in December 2002, Carlyle bought a third of Qinetic, the private subsidiary of the British military's Research and Development Center. Qinetic occupies a unique advisory role with the British government.

"To anticipate the technologies of the future and the enterprises which will develop them is our first role as an investor. Pension funds bring us their money for that. You can't blame us for trying to take strategic positions," Mr. Ullmann stresses.

This article originally appeared in Le Monde Diplomatique. - & counterpunch.org

|

|

Last year, former President Bush visited Saudi Arabia's King Fahd bin Abdul Aziz Al-Saud, but a Carlyle spokesman said the two did not discuss Carlyle business as previously reported. The elder Bush is reportedly paid between $80,000 and $100,000 for each Carlyle speech he makes. The company declined comment on the former president's pay.

The Carlyle Group has also served as a paid adviser to the Saudi monarchy on the so-called ``Economic Offset Program,'' an arrangement that effectively requires U.S. arms manufacturers selling weapons to Saudi Arabia to give back a portion of their revenues in the form of contracts to Saudi businesses, most of whom are connected to the royal family. A company spokesman said yesterday that arrangement was ended ``a few months ago,'' but said he did not know whether it was terminated before or after the Sept. 11 attacks.

A spokesman for former President Bush, reached yesterday, had no immediate comment on his work for the Carlyle Group.

These intricate personal and financial links have led to virtual silence in the administration on Saudi Arabia's failings in dealing with terrorists like bin Laden, said Charles Lewis, executive director of the Center for Public Integrity, a Washington, D.C.-based government watchdog group. - common dreams

U.S. Fiscal Year 2003:

"Section 655" Report

more from Federation of American Scientists

|

|

"The Washington-based Center for Public Integrity, a nonprofit, nonpartisan group, has been investigating Carlyle's connections with former government officials. But information on Carlyle and its subsidiaries is hard to find because private companies are not compelled to reveal their inner workings, and Carlyle does not volunteer information, said Peter Eisner, the group's managing director.

"We don't know anything about former President Bush's financial arrangement with Carlyle, who his contacts are when he travels as a representative of Carlyle, and what information he provides back to his son or anybody in the U.S. government," Eisner said.

The revolving-door between government and business has been spinning merrily for many years. Henry Kissinger, who was secretary of state and national security adviser for Presidents Nixon and Ford, started a consulting firm that has made him a multimillionaire since he left government service.

William Cohen, a former Republican senator from Maine who was President Clinton's defense secretary, is a consultant to corporations. Clinton's national security adviser, Sandy Berger; his former chief of staff, Mack McClarty; his ambassador to the United Nations, Richard Holbrooke; and the former chairman of the Federal Communications Commission, William Kennard, also are cashing in on their years of government service. Kennard has signed on with Carlyle.

The Semi-Daily Journal of Economist Brad DeLong

|

Carlyle fingers in many pies: the global control & surveillance grid

"The Carlyle Group focuses on companies funded by the government such as defense contractors and other companies affected by government, regulations, such as telecommunications. But its interests and investments go beyond defense industies and include a European auto parts company, a Japanese DSL company and Silicon Valley startups. In fact, 25 percent of its profits come from real estate investments.

However, Carlyle is mostly associated with and interested in the defense industry, whose budget the Bush administration is proposing to increase by over $40 billion, on top of the $437 billion provided by the 2003 Federal Budget. Getting as much as they can out of that budget is the goal of the Carlyle Group, and that helps to explain the coming together of so many top former Defense Department and other former government Big Wigs like Carlucci, Kennard and Baker, among others.

"

Just what is the Carlyle Group?

|

|

Carlyle now manages more than $25 billion of equity capital through 28 separate funds. These funds are managed by nearly 300 investment professionals operating from 24 offices in 14 countries. In addition to the buyout funds dedicated to the U.S. and Europe, Carlyle manages Carlyle Japan Partners with $423 million and Carlyle Asia Partners with $750 million. Also, Carlyle and Riverstone Holdings co-manage Carlyle/Riverstone Global Energy and Power I & II with $1.3 billion combined.

Carlyle Partners IV is the successor fund to Carlyle Partners III, which launched in 2000 at $3.9 billion. Carlyle Europe Partners II is the successor fund to Carlyle Europe Partners, which launched in 1998 at €1 billion.

- thecarlylegroup.com

|

The carlyle group are a 'corporate country' with their own economy built on defense and intelligence.

WAR as we previously thought of it, now becomes something not quite so chaotic and haphazard...

It is a force multiplier, an economic axis.

Thus the creation of chaos globally and the need for security is a market necessity.

Bush Carlyle Iraq WMD connections

Former members of a military intelligence team deployed to Iraq at the outset of the Iraq invasion referred to their job as a "janitorial operation for the first President Bush and Carlyle."

They were referring to the war profiteering firm, on whose international board George H. W. Bush sits and which was headed by Frank Carlucci, the Defense Secretary (and Princeton roommate of Donald Rumsfeld, who was Reagan's special envoy to Saddam Hussein in 1984) who served as the head of the Pentagon when the shipments to Iraq of VX nerve gas, other weapons of mass destruction, and conventional weapons were first authorized by the Reagan administration in 1988.

The military intelligence personnel claimed that at the time, Carlyle was among the largest exporters of such weapons by the United States and that bills of lading and other documents presented to them at the Bilad weapons depot in Iraq point to pass through companies affiliated with Carlyle being involved in the shipments to Iraq.

The evidence is contained in digital photographs and videos taken of canisters and documents by the U.S. military team and which are now in the secured possession of the 223rd Military Intelligence Battalion in San Francisco.

The VX weapons were found in retrofitted high explosive single stage, solid welding aerial bombs that had been cut in half by Iraqi engineers and had installed as a second stage a compartment from which parachute-borne VX weapons would be dropped and explode at a pre-set height. The weapons were to be used against Iranian troops. The confirmation of the source of the munitions came from the head of munitions for the Iraqi Air Force. The Iraqi source said the bombs had been kept purposely hidden from the UN weapons inspectors and the retrofitting process was carefully guarded by the Mukhabarat. U.S. military intelligence teams found 29 such bombs at Bilad. The bills of lading provided by the Iraqis showed that the materials were shipped from the United States through trading companies in France and Spain. The word "Carlyle" was recalled from some of the documents, according to a U.S. military intelligence source. The FBI is aware of the evidence of U.S. chemical-biological weapons sales to Iraq but has not taken any action against those involved.

The Bush 2 administration's main priority at Bilad was to have the incriminating evidence of binary VX nerve gas from the United States removed. A British special operations hazardous material team removed the canisters with U.S. serial numbers. Although the Bush 2 administration highlighted documents presented by the Saddam Hussein government to the United Nations showing the sale of weapons and other embargoed equipment by French, Soviet (and Russian), German, and Yugoslavian firms to Iraq during the Iran-Iraq war and after, it quickly classified the documents pointing to the sale of U.S. and British weapons (including WMDs) to the Saddam Hussein regime. A military intelligence report on the incident at Bilad, which is just south of Camp Anaconda, was sent to Joint Task Force 7 in Baghdad and has been suppressed.

U.S. intelligence sources report that George H. W. Bush, while Vice President under Reagan, lobbied strenuously to get WMDs to Saddam Hussein.

The CIA, according to U.S. military intelligence agents, never considered the U.S.-supplied VX nerve gas to be a WMD after Desert Storm. Their reasoning was that because of its binary nature it had a shelf life and oxidization rendered it harmless after the outbreak of Desert Storm. In reality, the U.S. military sources said the CIA's admission that Iraq possessed harmless VX was a way for it to protect itself and its former deputy director Carlucci while admitting to the fact that the Bush administration had, in fact, supplied the deadly agent to Saddam Hussein. The CIA's main mission in the 1990s was regime change and Saddam's alleged possession of WMDs was merely a causa sina qua non for continued hostilities, overt and covert. A British colonel who was the head of the special operations team that removed the VX weapons from Bilad said his detection kit registered a positive reading.

U.S. military intelligence personnel also report that some of the incriminating evidence of U.S. WMD weapons transfers to Saddam Hussein may be lying at the bottom of Lake Tharthar, an artificial lake that is the site of Saddam's most opulent palace -- the Green Palace.

Wayne Madsen

|

Carlyle Covers Up

Naomi Klein - The Nation

Less than twenty-four hours after The Nation disclosed that former Secretary of State James Baker and the Carlyle Group were involved in a secret deal to profit from Iraq's debt to Kuwait, NBC was reporting that the deal was "dead." At The Nation, we started to get calls congratulating us on costing the Carlyle Group $1 billion, the sum the company would have received in an investment from the government of Kuwait in exchange for helping to extract $27 billion of unpaid debts from Iraq.

We were flattered (sort of), until we realized that Carlyle had just pulled off a major public relations coup. When the story broke, the notoriously secretive merchant bank needed to find a way to avoid a full-blown political scandal. It chose a bold tactic: In the face of overwhelming evidence of a glaring conflict of interest between Baker's stake in Carlyle and his post as George W. Bush's special envoy on Iraq's debt, Carlyle simply denied everything. The company issued a statement saying that it does not want to be involved in the Kuwait deal "in any way, shape or form and will not invest any money raised by the Consortium's efforts" and, furthermore, that "Carlyle was never a member of the Consortium." A spokesperson told the Financial Times that Carlyle had pulled out as soon as James Baker was appointed debt envoy, because his new political post made Carlyle's involvement "unsuitable." Mysteriously, there was no paper trail--just Carlyle's word that it had informed its business partners "orally."

You have to hand it to them: It was gutsy. In the leaked business proposal from the consortium to the Kuwaiti government--submitted almost two months after Baker's appointment--the Carlyle Group is named no fewer than forty-seven times; it is listed first among the companies involved in the consortium; and its partner James Baker is mentioned by name at least eleven times. In interviews, other consortium members, including Madeleine Albright's consulting firm, the Albright Group, confirmed that Carlyle was still involved, as did the office of the Prime Minister of Kuwait. Shahameen Sheikh, the consortium's CEO, told me that when Baker was named envoy in December, Carlyle was "very clear with us that they wanted to restrict their role to fund managers," but she said the firm was very much still a part of the deal.

That was exactly what Carlyle spokesman Christopher Ullman had told me. He also admitted that Carlyle would land a $1 billion investment if the proposal was accepted. After I reported these facts, Ullman even called to thank me for quoting him accurately.

So when I heard about Carlyle's about-face, I called Ullman to see what was up. I felt like I was talking to one of the brainwashed characters in The Manchurian Candidate, the Jonathan Demme remake about a Carlyle-esque company that conspires to put a mind-controlled candidate in the Oval Office. "We learned today that we did not even join the consortium," Ullman told me, drone-like. "When I spoke to you yesterday, I did not know that."

Amazingly, it worked. The story--which made front-page news around the world--vanished almost as soon as it had appeared in the press at home. The New York Times has not printed a word about Baker's conflict, despite the fact that when Baker was first appointed envoy, it published an editorial calling on him to resign from Carlyle in order to "perform honorably in his new public job." The Kerry campaign has been equally silent, apparently for fear that any criticism would boomerang onto the Democrats because of Albright. This was Carlyle's stroke of genius: When Baker was appointed, the consortium recruited Albright to front the deal; when they got caught, Carlyle denied all involvement in this "unsuitable" activity and left a prominent Democrat holding the bag.

As the story disappeared under Carlyle's spell, it was as if the entire US media had been implanted with Manchurian memory chips. Here was hard evidence that the Carlyle Group--the "ex-Presidents' club," run so much like a secret society that Charles Lewis of the Center for Public Integrity once described researching the firm as "shadowboxing with a ghost" --had participated in a scheme to use Baker to undermine US policy, possibly in violation of multiple conflict-of-interest regulations, including criminal statutes. Yet Carlyle was slipping out of reach once again.

Crucially, the central question remains unanswered by the White House: Have James Baker's business interests compromised his performance as debt envoy? That question does not go away simply because $1 billion will stay in the coffers of a wealthy oil emirate rather than in a Carlyle equity fund. The week after losing the deal, Carlyle handed a record-breaking $6.6 billion payout to investors. "It's the best 18 months we ever had," boasted Carlyle chief investment officer Bill Conway to the Financial Times. "We made money and we made it fast."

In Iraq, the last eighteen months have been markedly worse, and the stakes for Baker's job performance there are considerably higher. This was underlined on October 13, when Iraq's health ministry issued a harrowing report on its post-invasion health crisis, including outbreaks of typhoid and tuberculosis and soaring child and mother mortality rates. A week after the report came out, Iraq paid out another $195 million for war reparation debts, mostly to Kuwait. Meanwhile, the State Department announced that $3.5 billion for water, sanitation and electricity projects was being shifted to security in Iraq, claiming that, according to Deputy Secretary of State Richard Armitage, debt relief is on the way.

Is it? In fact, Iraq is being plunged deeper into debt, with $836 million in new loans and grants now flowing from the IMF and the World Bank. Meanwhile, Baker has not managed to get a single country to commit to eradicating Iraq's debts. Iraq's creditors know that while Baker was asking them to show forgiveness, his company was offering Kuwait a special side deal to push Iraq to pay up. It's not the kind of news that tends to generate generosity and good will. And the timing couldn't be worse: The Paris Club is about to meet to hash out a final deal on Iraq's debt.

But that doesn't happen until November 12. And if 2000 is any indication, by then Baker could be on to bigger deals. Look out for him in swing states, if another election needs stealing.

|

|

The Octopus companies links to Carlyle

IBM

Consider Louis Gerstner, the CEO of IBM for seven or so years: During his tenure the following events occurred.

(1) IBM was criminally convicted of selling super computers to the Russians for atomic weapon research. IBM received only a $8.5M fine and it was in the news for only one day.

(2) IBM sold one the largest supercomputer in the world to China via Hong Kong. It is reported to be used in the Chinese Echelon project.

(3) IBM was caught in bribing and payoffs in a $250M contract with Banco Nacio in Argentina. The trail lead back to IBM Corporate in NY. IBM had a similar incidence in Mexico. IBM bought their way out of it via the political influence and money. Gerstner hired Podesta Associates. The owner of this firm has a brother who is chief of staff to President Clinton. Consequently, Gerstner has an in the White House.

(4) When Companies and individuals get in the way of their plan...they die!!!...Judge Bagnasco witness in Argentina. Other examples the murder of Joan LoDato in Kingston NY.

(5) Under Gerstner leadership IBM set up an Institute to tell governments how to act in the Information Age. Gerstner is a member of the Tri Lateral Commission, the CFR...and a voice in the Bilderbergers.

(6) Under Gerstner leadership, tens of thousands of Americans lost their jobs at IBM. These same jobs were and are being transferred to IBM China and IBM India.

(7) Gerstner has a modest salary of only a few million a year. However, over his tenure he made over one billion dollars from his stock options.... A poor boy who became rich...and sold his soul and lack of concern for the USA for money...This is an example of the new NWO leaders.

The Story of the Secret base on Dominica and the Murders that Followed.

Louis Gerstner Chairman of the Carlyle Group -

November 21, 2002 - The Carlyle Group announced that Louis V. Gerstner, Jr. will become chairman of The Carlyle Group effective January 7, 2003

Mr. Gerstner has been chairman of IBM since 1993, and served as chief executive officer of IBM from 1993 until March 2002. He retires as chairman of IBM at the end of 2002.

Mr. Gerstner was awarded the designation of honorary Knight of the British Empire by Queen Elizabeth II in June 2001.

Feb 2, 2006 - Also investing with the Carlyle Group is Novak Biddle Venture Partners, a Maryland-based venture capital firm. Command Information, headed by Tom Patterson, former chief strategist of e-commerce at IBM, also announced Thursday that Command Information has merged with Digital Focus, an IT services company. -source

ATT,

for much of the 20th century, AT&T was the world's largest firm, in terms of both revenue and market capitalization. It was the preferred safe "widows and orphans" stock. It was the home of Bell Labs, a spectacular source of innovation produced the transistor, the laser, and a number of Nobel Prize winners. It had amazing cash flow.

The article quotes, Clayton Christensen of Harvard Business School, author of the excellent book The Innovator's Dilemma as noting "The world is filled with companies that are marvelously innovative from a technical point of view, but completely unable to innovate on a business model." AT&T simply wasn't ready to compete after the 1984 breakup of its monopoly. It missed out on the rise of computers, on wireless technology, and on the Internet, even though it had years to adapt to those changes after the breakup. By the time AT&T started to adapt to what was changing, it was too late. - source

It was a long and bitter antitrust case. By court order, AT&T was divided up into seven regional Bell Operating Companies (RBOCs), along with a long-distance company (holding the AT&T name). The telephone research laboratory (Bellcore) was a resource shared by all.

The court decision was one of the biggest antitrust decisions ever. The most comparable forced breakup was that of Rockefeller's Standard Oil trust 1911. And as the Standard Oil dissolution led to regional "Baby Standards" (Sohio, Socal, Socony, etc.), so the Bell breakup led to "Baby Bells." source

Wei Deng is a Vice President focused on real estate opportunities in China. He is based in Beijing, China. Prior to joining Carlyle, Mr. Deng was a Vice President at Merrill Lynch in Beijing, where he focused on real estate investments in China. Prior to that, he was a Vice President at H&Q Asia Pacific focusing on private equity investments. He has also held numerous positions at both AT&T and MCI Worldcom in the U.S. - source

|

|

Avio SpA

Avio SpA is a leading Italian manufacturer of aeroengines and space propulsion systems.

Avio designs, develops, and produces subsystems for military and civil aeroengines and propulsion systems for space launch vehicles. The company produces components of aeronautical engines, accessory gearboxes, low-pressure turbines, and naval and space propulsion systems. Avio also performs aeroengine maintenance, repair and overhaul.

Avio was formerly the aerospace arm of FiatAvio SpA, the leading Italian manufacturer of aircraft and naval engines. In September 2003, The Carlyle Group and Finmeccanica acquired Avio from Fiat Group for approximately €1.6 billion. Carlyle owns 70 percent and Finmeccanica owns the remainder.

The Carlyle aerospace team joined the Carlyle Italian team to close the Avio transaction. The combination of sector expertise and local insight enabled Carlyle to complete the acquisition.

Marco de Benedetti, Managing Director at The Carlyle Group and head of the Italian buyout team, said, "We are working closely with management to develop further Avio's products, services and markets to fully reach the company's great potential." - thecarlylegroup.com

| Avio S.p.A. is an Italian aerospace engine manufacturer. Formerly owned by FIAT S.p.A. and named FiatAvio, it is now owned by The Carlyle Group. Avio chiefly serves as a subcontractor to first-tier jet engine manufacturers, or in a partnership role in consortiums.

Products

Civil

GE90, subcontracting to General Electric.

GEnx, subcontracting to General Electric.

T700, subcontracting to General Electric.

Trent 900, subcontracting to Rolls-Royce.

PW150, subcontracting to Pratt & Whitney Canada.

PW308, subcontracting to Pratt & Whitney Canada.

PW625, subcontracting to Pratt & Whitney Canada.

PW800, subcontracting to Pratt & Whitney Canada.

Military

Spey, subcontracting to Rolls-Royce

T700, subcontracting to General Electric.

F119, subcontracting to Pratt & Whitney.

RB199, as part of the Turbo-Union consortium.

EJ200, as part of the Eurojet consortium.

Auxiliary power units

Space

Ariane III (with SNECMA and SME)

Ariane IV (with SNECMA and SME)

Ariane V (with SNECMA and SME)

Vega

Marine

LM2500, subcontracting to General Electric.

LM6000, subcontracting to General Electric.

wikipedia.org

|

|

|

|

"Consumers are being tracked, catalogued surveilled and their "data" is being warehoused, filed and mapped with increasing detail. This is happening without our knowledge or consent. This invasive spying is currently confined to loading docks at WalMart, Target and Metro Future stores, but is ready to follow you home if you aren't careful about RFID technology. RFID stands for Radio Frequency Identification and is a term that will become increasingly well known as usage of the new technology becomes pervasive. There is no question that the tiny chips, which enable tracking of physical goods from the assembly line to warehouse to retail outlet to checkstand, will replace the barcodes previously used for that purpose. Some RFID chips are so tiny, they are nearly indistiguishable from dust in many cases."

The Coming Privacy Storm Over RFID Chips

"Human rights organisations from Europe, North America, Australia and Asia have sent an open letter to the International Civil Aviation Organisation (ICAO) railing against plans to create an international 'identity register' that would force the inclusion of biometrics and controversial RFID tracking tags in all passports by 2015. "

One billion people to get biometrics and RFID tracking by 2015

|

|

Matrics bets chips on $14M launch

Cheaper ID technology could lead to extinction of bar codes -

Washington Business Journal

- January 11, 2002 by Martin Kady II

For more than two years, a team of former National Security Agency scientists has eschewed the Internet boom in favor of a simpler task: building a better radio frequency identification chip known as RFID.

Now the company, Matrics, is ready to launch, and it's doing so with a $14 million investment from venture capital firms Novak Biddle Venture Partners, The Carlyle Group, Polaris Venture Partners and Venturehouse Group.

Matrics (http://www.matricsrfid.com) closed the deal in December, but has chosen to lay low until its product is launched. What the company promises is a cheaper, smarter version of the RFID tag, which could be attached to virtually any product that needs tracking, from DVDs in a video store to engine turbines in an airport hangar.

Ideally, a cheap RFID could replace the ubiquitous UPC bar codes on consumer goods because it can track more information.

For now, however, Matrics is pitching its product for supply chain management, some retail uses and to any business that needs to track thousands of products or parts. The Matrics product, embedded with the RF chip, is a thin, flexible piece of silicon about the size and shape of a large Band-Aid. With this RFID, there is no need for a person to scan the device because it can be done by a remote sensor.

While RFID may not be a household term, many people use the product in everyday life.

When you see the cars on the Dulles Toll Road zip by in the fast lane using an E-ZPass, they're using RF chips. If you've ever had a small device on your key chain that you wave in front of a scanner to unlock a door, it's probably an RFID. The Mobil SpeedPass used to pay at the pump at Mobil gas stations also operates on RFIDs.

These radio frequency chips are in heavy use, but they're limited because they can be expensive, don't have good range and can't process much information.

What Matrics has done, according to those familiar with its technology, is solve the riddles of cost, range and processing that have limited past generations of RFID devices. The Matrics prototype can be made for about 30 cents and can be read by a scanner from 15 feet away. In addition, the scanner Matrics is using can simultaneously read thousands of RFID tags.

The ability to read multiple tags at once is a key distinction. If every videotape or DVD in a video store had an RFID attached, the manager could do a quick scan of the entire store to immediately learn what's in stock, what's checked out and whether anything has been stolen.

|

|

SKY Computers IS Analogic

SKY Computers, Inc., a wholly owned subsidiary of Analogic Corporation (Nasdaq: ALOG), is the leading supplier of standards-based, embedded high-performance computer systems. SKY's broad range of commercial-off-the-shelf products meets the embedded computing requirements for high-performance embedded computing applications. Standards and open-source software are combined with advanced technologies to provide solutions for demanding government electronics, industrial inspection, medical imaging, and security applications.

source

Sky computers

|

Matrics IS Carlyle

"Matrics was created with a vision to revolutionize the logistics and supply chain processes by deploying breakthrough RFID systems.

Today, as Matrics is delivering customer success in pursuit of their vision, Bill and Mike continue to serve the company enthusiastically as Chief Scientist and Chief Technology Officer, respectively."

"MATRICS" is Carlyle Group Subsidiary Alex Jones

|

SKY Computers and QinetiQ

SKY Computers and QinetiQ Partner to Offer Embedded Real-Time Signal Processing Solutions

Joint Sales and Marketing Agreement Will Evaluate and Assess Intellectual Property and Technology for Demanding Signal Processing Systems

CHELMSFORD, MA and MALVERN, U.K (Oct. 10, 2003) SKY Computers, Inc., a subsidiary of Analogic Corporation (NASDAQ: ALOG), announced it has entered into a collaboration agreement with QinetiQ to pursue new business opportunities for products and services based on QinetiQ's embedded systems technology and SKY's embedded high-performance computing platform. Under the sales and marketing agreement, SKY Computers and QinetiQ's Real-Time Embedded Systems Group will evaluate and assess complementary capabilities and develop plans to integrate, customize and deploy embedded signal processing solutions for new and current customers.

QinetiQ, formed out of the British Government's Defence Evaluation & Research Agency, is a leader in the design, development and application of Field Programmable Gate Array (FPGA) cores and other technologies for embedded signal processing solutions. FPGA cores describe reusable components, encapsulating a specific function, which can be employed by a user as a building block when creating system designs for an FPGA. SKY Computers is a leading manufacturer and supplier of high-performance embedded computer systems and solutions for signal intelligence, industrial inspection, radar processing and other applications demanding high computational power.

SKY and QinetiQ will collaborate on new business opportunities for products and associated services in markets that require demanding signal process solutions. The companies will also work together to determine the feasibility of applying sensor-based technologies and FPGA-based I/O interfaces for growth markets that could include medical imaging, industrial inspection and homeland security. The collaboration will determine how FPGA cores can be used to facilitate high-performance, high-density implementations to support demanding image processing algorithms and computation needs. FPGAs allow for efficient implementation of highly parallel, low-word-length, compute-intensive functions typically needed close to the sensor front end in signal processing systems. Adding an FPGA capability to SKY's Altivec G4 based processing architecture will create an extremely powerful solution for implementing the most demanding processing algorithms.

"SKY Computers and QinetiQ are partnering to address the needs of high-end system engineers who are accessing and processing rapidly increasing amounts of data," said Bill Smith, business group manager at QinetiQ. "Through this alliance, our companies will look at offering customers a powerful, effective hardware/software solution that could dramatically improve performance within their embedded systems."

"With this collaborative effort, SKY Computers and QinetiQ will look to improve systems performance for embedded signal processing applications with a focus on FPGA and I/O processing architecture," said Mark Pacelle, vice president, marketing, SKY Computers. "Users who require top performance and flexibility in demanding signal processing applications will benefit from our shared resources and approach."

Partners

|

|

|

Carlyle and QinetiQ

Carlyle supports QinetiQ's plan to develop its non-MoD business by commercialising technologies first developed for the defence industry into applications for a much broader range of sectors. Carlyle employs more than 60 investment professionals, who are dedicated to investing in technology through the firm's venture capital funds in Asia, Europe and the US. This team will be in a strong position to provide QinetiQ with contacts across the globe that can be called upon for advice in the technology field. We hope that access to a global network will help QinetiQ's commercial development and are pleased to make this additional resource available across the company.

Carlyle & QinetiQ

|

Carlyle Group...Qineteq...it's the usual suspects

It's all connected

Border control - Echelon - over the horizon radar -

EMF surveillance Global positioning Satellite systems,

Privatized intelligence companies

|

What is QinetiQ?

A Private Anglo / American Darpa

The Strategic Defence Review undertaken by MoD in 1998 recommended a Public Private Partnership (PPP) arrangement as the best means of maximising the strategic value and operational cost effectiveness of the United Kingdom's defence research capabilities. Accordingly, QinetiQ has been structured to facilitate involvement by the private sector.

It comprises the greater part of DERA, the British Government's "Defence Evaluation and Research Agency". Until July 2001, DERA was an agency of the UK Ministry of Defence, incorporating the bulk of the MoD's non-nuclear research, technology and test and evaluation establishments. It then split into two organisations, DSTL and QinetiQ Group plc. DSTL remains part of the MOD and continues to handle the most sensitive areas of research. - factsheet

|

Sir John Chisholm,

Sir John Chisholm,

QinetiQ's Chief Executive Officer

|

|

As chief executive of Qinetiq (the commercial arm of what used to be called the Defence Evaluation and Research Agency) Sir John, 57, thrives in the brave new world of "smart procurement" and "network enabled warfare" and that is precisely what the cutbacks in front-line forces will help to pay for. Out goes a battalion or three, in comes the whizz-bang technology needed to fight "asymmetric" wars - the ones where we have overwhelming military might if only we could locate the enemy.

"The UK defence market is still a huge one," Sir John says. "It is worth some 30bn a year and we are very much in the sweet spot of that, bringing technology out of the laboratory and on to the battlefield in a way that makes soldiers, sailors and airmen more effective. The market for testing and evaluation alone is worth about 2bn a year and we are really the only player. In the US, the market is worth 20bn but there are 1,000 competitors fighting for the work.

|

|

"Everywhere you go you will find interesting technology, all of which came out of the military world. Armed forces need first-rate technology. You have to be best, if you are not then you are dead."

If Sir John sounds like a salesman, then that is precisely what he has become, selling Qinetiq not only to a worldwide customer base but also to would-be investors.

Eighteen months ago, Qinetiq became a Public-Private Partnership after the American private equity firm Carlyle paid 150m for a 32 per cent stake. More recently, the Government has begun preparations for the stock market flotation of the business by appointing Morgan Stanley as its investment banking advisers. -

|

|

| QinetiQs HAARP experiments - UK advanced weapons & defense

Generation of ELF (30-3000 Hz) and VLF (3-30 kHz) electromagnetic radiation by conventional techniques requires the use of very large and expensive antennas. However, it is possible ot generate ELF/VLF radiowaves indirectly by heating the ionosphere with a high powered HF (3-30 MHz) radio 'heater'. Modulating the heater power at ELF/VLF frequencies leads to a modulation in the ionospheric conductivity. This in turn modulates the natural currents flowing in the ionosphere such that the heated region radiates at the frequency of modulation.

QinetiQ has developed a model that simulates the ELF/VLF radiation emitted from the lower ionosphere as a result of square wave modulated-heating from a ground-based HF transmitter. The model determines height profiles of the electron temperature variations based on calculations of the characteristic heating and cooling times of the ionospheric plasma. The total radiated power and the magnetic field strength of the ELF/VLF radiation at the ground are then calculated by modelling the heated region as a Hertzian dipole antenna.

The model assumes a circular beam with a Gaussian power profile (see figure below). The beam may be launched at any angle of elevation and azimuth. In the model, the power is cycled on and off at the frequency of the desired ELF/VLF signal. QinetiQ is also developing a model of ionospheric heating by continuous-wave, dual frequency heaters.

Ionospheric heating QinetiQ

|

|

Variations in the solar, magnetospheric, and ionospheric environment can affect a variety of ground-based and space-borne technological systems (e.g. high frequency (HF) communications, the Global Positioning System (GPS), ultra high frequency (UHF) satellite communications, as well as spacecrafts, pipelines and cable networks, etc.) These may have important socio-economical impacts, and hence the ability to forecast disturbances in the solar-terrestrial environment is valuable.

Traditional linear modeling techniques often fail to improve on the reference recurrence and persistence models due to the incomplete understanding of the solar-magnetospheric-ionospheric interactions and the typically noisy and non-stationary nature of solar-geophysical data sets. The use of knowledge-independent (time series) analysis techniques is therefore an attractive alternative approach.

The Ionospheric Forecasting Demonstrator (IFD) developed by QinetiQ utilises nonlinear modeling techniques to make real-time forecasts of ionospheric parameters

QinetiQ

|

Disclaimer:

The ionospheric data may not be used for commercial gain and QinetiQ accepts no responsibility for their use.

[yeah...Right!]

|

|

Sale of a Stake in QinetiQ PLC to The Carlyle Group

December 05, 2002 #2002-24 London -

The Ministry of Defence has agreed the terms under which The Carlyle Group will become its strategic partner to assist in the future development of QinetiQ, Defence Minister Lewis Moonie announced today.

Dr Moonie said: "The strategic partnership with The Carlyle Group keeps QinetiQ on course to become a leading science and technology company that aspires to be the envy of the world. The Carlyle Group shares our vision for the future of QinetiQ and is well placed to support the management team in building a company, which we expect to flourish commercially, based on its commitment to excellence."

"QinetiQ will remain a British company based in the UK. MOD will retain a Special Share in the business to ensure that the nation's defence and security interests continue to be protected. There will also be robust safeguards to prevent conflicts of interest and to ensure that the integrity of the Government's procurement process is not compromised".

"This is good news for taxpayers, who will benefit from the immediate sale proceeds as well as from QinetiQ's potential increase in value over time. And it is good news for QinetiQ's employees who will have the opportunity to invest in the future of the business through a staff equity scheme and will each receive a small free allocation of share options. Today's announcement marks a new future for science and technology in Britain."

The sale follows MOD's decision in March this year to seek a strategic partner to invest in QinetiQ, and the selection of The Carlyle Group as preferred bidder in September. The transaction values QinetiQ at around £500m. Following adjustments to reflect current assets and liabilities, MOD will receive between £140 and £150m from the transaction (the final amount will depend on the company's exact financial position at completion), in addition to £50m already received from QinetiQ as part of the purchase price for its assets. Subject to the satisfactory fulfilment of a number of final conditions, formal completion of the sale process is expected early in the New Year,

Carlyle will acquire a 33.8% economic interest in QinetiQ with a further 3.7% of the shares to be made available for the employees. MOD's retention of a 62.5% current stake in the business will ensure that the taxpayer shares in the benefits of the growth in QinetiQ, which we anticipate will follow the introduction of a strategic partner. The MOD plans to sell its entire stake in QinetiQ within 3-5 years, probably through a flotation on the stock market.

Management control and responsibility for setting future commercial strategy will now lie with QinetiQ and The Carlyle Group, allowing them to make appropriate decisions to grow the value of the business. MOD will retain those rights which are conventional for a major shareholder.

QinetiQ's Board of Directors, chaired by Dame Pauline Neville-Jones, will be augmented by the appointment of two Carlyle nominees - Glenn Youngkin, a Managing Director of The Carlyle Group, and Sir Denys Henderson. MOD also has the right to appoint two non-executive directors.

Sir John Chisholm, QinetiQ's Chief Executive commented: "Working together, QinetiQ and The Carlyle Group will be a strong team with complementary experience. We can now be even more confident of achieving our ultimate goal of moving from a European leader to a global technological solutions provider for our diverse range of customers. Carlyle's investment secures a bright, long-term future for our business, our employees and our customers."

Glenn Youngkin, The Carlyle Group's Managing Director in London, commented: "We are impressed with the quality of the business and are looking forward to supporting such a capable and ambitious management team. We can see enormous opportunities to grow the value of the business, harnessing innovation to create profitable commercial applications."

|

|

MoD PLC

Arms trade. Government sweeteners. Tax havens. Dodgy corporations making a killing. Directors paying themselves a packet. Ridiculous company names. Welcome to Neo Labour's first full blown privatisation.

In case you missed it while checking your portfolios(!), last week 'defence research' group QinetiQ was floated on the stock exchange, which even in the world of cut-throat capitalism raised quite a few eyebrows and mutterings of 'rip off' - even from those unconcerned about the whole profiting-from-killing-people business.

QinetiQ was created in 2001, when the Ministry of Defence's Defence Research Agency was split in two. The most sensitive work was taken on by the Defence Science and Technical Laboratory and the rest given to QinetiQ which, until last week, was still half owned by the MoD.

In 2002 everyone's favourite secretive US equity power-players the Carlyle Group (See SchNEWS 380) - whose board includes such 'luminaries' as former PM, John Major and Big Daddy Bush - paid a mere £42 million for a third of QinetiQ and management control in the privatisation deal - one that actually cost the taxpayer double that amount in legal and advisory fees. Carlyle also managed to get out of any responsibility for expensive environmental liabilities, and then immediately started selling off thousands of acres of former military training grounds, target sites, tank lands and air strips for housing. Now thanks to the stockmarket flotation they have netted a cool £227 million.

Also doing very nicely out of the flotation are QinetiQ's own fat cats. Chairman Sir John Chisholm has a potential windfall of £25m and chief executive Graham Love stands to trouser £22m. This makes a neat £42 million profit for shares they awarded themselves, swindling the taxpayer at the same time.

There's been plenty of room at the trough for others however: consultants, advisers and other service providers also netted more than £100m by the time the flotation was completed, while investment banks and their clients - the faceless hedge funds and investing institutions who can be relied on to hoover up the shares - will turn a nice, quick profit out of the flotation process.

Seems that everyone has made a killing out of a dodgy arms company. But with Neo Labour forever banging on about the threat of terrorism and demanding new laws, why did they rush to sell off the UK's sensitive defence-related inventions - from anti-missile programmes to guided weapons? Even QinetiQ have warned that it may not be able to "deter misappropriation of its confidential information." Oh well as long as the profits keeping flowing in…

Last year 73 per cent of QinetiQ's revenue came from the MoD, thanks to a cosy contract known as the Long Term Partnering Agreement. This agreement means QinetiQ runs the government's test ranges for the next 25 years in a deal worth up to £5.6 billion. With such guaranteed income, no wonder everyone was trying to clamber on board.

MISBE-TAX-HAVEN

The National Audit Office, which monitors public sector spending, has said it will look at a range of issues raised by the privatisation, and would "examine whether the privatisation of QinetiQ was good value for money", including whether Carlyle's stake was sold too cheaply. Meanwhile former Labour defence procurement minister Lord Gilbert, says "the MoD was taken like a lamb to the slaughter", loading up the company with a contract backed by the taxpayer in order to privatise it. "The sale was very much akin to Boris Yeltsin handing out the assets of the old Soviet Union to his chums at knockdown prices."

Part of the Audit Office inquiry will also look at the investment bank UBS. It was UBS who advised ministers on the sale of QinetiQ to Carlyle. On the company payroll was one James Sassoon, the bank's head of privatisation. In 2002 Sassoon moved to the Treasury to help advise them on, amongst other things, public private partnerships - like QinetiQ! Sassoon is well known to the Audit Office, as he was head of the privatisation team who helped with the sale of Railtrack, perhaps the biggest privatisation cock-up of them all.

In the past, such dodgy privatisation deals have been justified on the grounds that corporate profits are good for the Exchequer. Not so QinetiQ. Not only did Carlyle get the company cheap, it also bought its stake though a series of "special purpose vehicles" based in Guernsey, which means that it will not be paying tax on the sale of its shares - and it says that the government knew about the tax haven before the deal was done. In fact, the QinetiQ story has some parallels with the sale of the Inland Revenue's buildings to Mapeley - an offshore property company registered in Bermuda. While the Inland Revenue will relentlessly pursue anyone who owes them cash, the government was happy to sell all their buildings to Mapeley who do their very best to pay no taxes in this country.

On an economic level the QinetiQ deal makes no sense, but on another level, it all falls into place with the free-market privatisation zeal of the Neo Labour fundamentalists. It just so happens that all the bean-counters and bankers that advise the government that the best thing they could do is to flog off the nations silver - schools, hospitals, inland revenue buildings - are the very same people that end up making shed loads of cash out of those same deals. Who said government wasn't transparent enough?

* For more on the Carlyle Group see www.hereinreality.com/carlyle.html

schnews.org

|

|

| Carlyle Group owned QinetiQ involved in Asteroid threat evaluation

ESA has been addressing the problem of how to prevent large Near-Earth Objects (NEOs) from colliding with the Earth for some time. In 1996 the Council of Europe called for the Agency to take action as part of a long-term global strategy for remedies against possible impacts . Recommendations from other international organisations, including the UN and the Organisation for Economic Cooperation and Development (OECD), soon followed.

ESA commissioned a number of threat evaluation and mission studies through its General Studies Programme (GSP). In July 2004 the preliminary phase was completed when a panel of experts appointed by ESA recommended giving the Don Quijote asteroid-deflecting mission concept maximum priority for implementation.

Now it is time for industry to put forward their best design solutions for the mission. Following an invitation to tender and the subsequent evaluation process, three industrial teams have been awarded a contract to carry out the mission phase-A studies:

a team with Alcatel Alenia Space as prime contractor includes subcontractors and consultants from across Europe and Canada; Alcatel Alenia Space developed the Huygens Titan probe and is currently working on the ExoMars mission

a consortium led by EADS Astrium, which includes Deimos Space from Spain and consultants from several European countries, brings their experience of working on the design of many successful ESA interplanetary missions such as Rosetta, Mars and Venus Express

a team led by QinetiQ (UK), which includes companies and partners in Sweden and Belgium, draws on their expertise in mini and micro satellites including ESA s SMART-1 and Proba projects

This month the three teams began work and a critical milestone will take place in October when the studies will be reviewed by ESA with the support of an international panel of experts. The results of this phase will be available next year.

|

|

Royal banker to take new mantle

By Andrew Cave Associate City Editor (Telegraph

Filed: 19/12/2001)

ANDREW FISHER is to leave his job as head of Coutts, the Queen's banker, for a role at a private equity company whose star-studded board includes former prime minister John Major. Mr Fisher, 40, Coutts Group chief executive, is joining Carlyle Group, the US private equity firm that employs former US secretary of state James Baker as senior counsellor. Former Securities & Exchange Commission chairman Arthur Levitt is a senior adviser and former US defence secretary Frank Carlucci is chairman. [note: now ex IBM Louis Gerstner]

Mr Fisher will be succeeded at Coutts by Gordon Pell, who joined NatWest as part of the bank's unsuccessful attempt to fend off the Royal Bank of Scotland's hostile takeover bid. Mr Pell, 51, arrived at NatWest in January 2000 from Lloyds TSB, where he was chief executive of UK banking. He became chief executive of NatWest's retail banking and took on the same role at RBS when it completed the takeover.

Mr Pell will continue to be chairman of retail banking and wealth management at RBS, which gained ownership of Coutts in the takeover.

Mr Fisher, who joined Coutts in January 1998, will focus on wealth management at Carlyle, although his exact role has yet to be confirmed.

Julie Cooper, speaking for Coutts, said: "Andrew Fisher has told us that this is something he has wanted to do for some time. It has always been in the back of his mind."

Coutts, which requires customers to have minimum assets of £500,000 in cash or £5m-worth of property, has increased UK profits from £41m in 1998 to £65m last year.

Carlyle Group, which has its headquarters in Washington DC, has invested $6.4 billion in 233 corporate and property deals since it was founded in 1987. Its mission is to become the "premier global private equity firm and to generate extraordinary returns".

|

|

KDDI, one of the three major mobile carriers in Japan, will soon introduce wallet phones (you can call them EZ FeliCa-compliant handsets if you like lengthy names). It is basically the same thing as what NTT DoCoMo introduced last summer. Two new KDDI/au handsets (W32S and W32H) having embedded FeliCa RFID chips will be introduced this September. Users of these handsets will likely be able to use mobile SUICA service (the service that allows people to use mobile phones as RFID train passes) as well in January 2006. Until then, they will be just good old wallet phones.

ubiks.net/l

|

|

Carlyle Group Buys Part Of KDDI

Japanese mobile carrier KDDI has been trying to sell their DDI Pocket division for many months (leading to the inevitable joke/question of whether or not KDDI minus DDI will be simply known as "K"?).

DDI Pocket offers the personal handyphone system, which is popular in Japan. It's sort of a cheap approximation of a mobile phone system, but has found new life in supplying wireless data access to Japanese users. The expected buyer from the beginning of all this talk has always been Kyocera, who already owned a small piece of DDI pocket.

Despite denials, it looks like Kyocera is buying up DDI pocket, but they've brought in quite the powerhouse partner - which will actually make them the smaller player in the deal. The Carlyle Group has announced that they'll be teaming up with Kyocera to buy DDI Pocket.

The Carlyle Group, of course, is known for hiring up big shot political insiders and other world leaders (such as Lou Gerstner) so they certainly have a few connections up their sleeves.

They'll now own 60% of the firm and apparently are looking to bring the technology to developing countries that might not have the infrastructure for a full mobile phone system, but could find the PHS system useful.

KDDI, in the meantime, will focus on their real mobile phone market in Japan, which was starting to eat into the DDI Pocket market anyway. It's an interesting look at how a technology that is becoming obsolete in an advanced society could present huge opportunities for developing nations instead. As the second link above shows, this also shows how Japanese firms are increasingly open to being bought by foreign firms -- something that's been rare in the past (though, Ripplewood's buyout of J-Phone's landline business in Japan suggests a trend).

- techdirt.com

|

Radio Frequency Identification

via Global Positioning Satellite systems

via Bluetooth, 3G & next generation internet:

The next generation internet is integral to

Global surveillance, command & access control Economy

|

Command information: IPv6 Insights

America's Quest for IPv6

IPv6, already available to forward-thinking countries and organizations, provides features and functions that will sustain a global advantage over their competitors. In this original series we explore America's coming transition to IPv6 from both business and financial perspectives.

While IPv6 has been around for over a decade, and is well known within its tight-knit global community, it's telling who else is now taking note. We recently had the opportunity to discuss the possibilities associated with the adoption of IPv6 with a series of noteworthy establishments. Just this past March, we were providing IPv6 briefings to mainstream business magazines such as Forbes and BusinessWeek, financial news services such as Bloomberg and MarketWatch, and speaking to groups including the Association for Corporate Growth and the Potomac Officers Club.

The common denominator among all of these groups is the ever widening interest in how the coming upgrade to the next generation Internet will affect our society. Discussions embraced enhancing American competitiveness, lowering real costs, identifying new IP services, targeting the first sectors to see benefits, focusing on where to invest, keys to timing and details of adoption among the DoD, Civilian government, and Fortune 500 organizations. All of this really came together at one event, on March 30th, in Falls Church, Virginia.

Congressman Tom Davis, the Chairman of the Government Reform committee, who has had more to do with advancing the Government's information readiness than any other person on the Hill, started the discussion with a passionate account of how the Government is doing it's part by mandating that the single largest IT buyer in the world buy IPv6 products and services. The Congressman then went on to discuss not the mandate, but how the mission of the Federal Government will be helped by leveraging this new infrastructure -- citing focuses across the board including helping the warfighter and enabling better home health care for baby boomers via tele-medicine.

I then led a wide-ranging discussion with people that are leading real IPv6 efforts across a variety of organizations, including the DoD, the Intelligence Communities, Civilian agencies, and the Fortune 500. While there were many specifics drawn out from our experts, several common themes were developed, including a focus on real cost savings and the availability of brand new, easy-to-use and cost effective IP-based services.

Latif Ladid, the global leader of the IPv6 Forum, then helped put American efforts into a global perspective, with an enlightening talk about the efforts of other countries and regions, including China, Korea, Japan, the European Union and Brazil -- all with active IPv6 plans in various stages of implementation.

Finally, Lt.Col Jim Baucchus gave a stirring account of the military's need for IPv6, focused again on where it will help the warfighter, and helping to put IPv6 into an historical context.

All together, this past month was exhilarating, with so many new minds beginning to focus on what so many have fought so long for -- the first significant upgrade to the Internet in over 30 years.

command information

America's Quest for IPv6

IPv6, already available to forward-thinking countries and organizations, provides features and functions that will sustain a global advantage over their competitors. In this original series we explore America's coming transition to IPv6 from both business and financial perspectives.

In part one, A Business Perspective, we demonstrate the business case for the U.S. to embrace IPv6.

Download Part I

In part two, An Analysis of the Business & Financial IPv6 Marketplace, we examine the business facts and figures behind this rapidly sweeping technology.

Download Part II

|

The Carlyle Group and Novak Biddle Venture Partners Launch Command Information, a New Company Addressing Fortune 1000 and Government Customers' Migration to the Next Generation of the Internet; Command Information Merges with Digital Focus, a Leading Application Development Company

February 02, 2006 #2006-14pc (issued by portfolio company)

In First Week, Newly Launched Company Addressing Next Generation of the Internet Merges with Agile Software Leader; Command Information and Digital Focus Join Forces to Aid Government and Fortune 1000 Companies with Burgeoning IPv6 Market

Herndon,VA - The nation is transitioning from the current Internet protocol to IPv6, a more robust, secure and flexible way to communicate over the Internet. Leading the transition, Command Information launches this week to provide government organizations and Fortune 1000 companies with solutions and services every step of the way of their IPv6 migration. The company is backed by investments from The Carlyle Group and Novak Biddle Venture Partners.

"IPv6 is vital to the future competitiveness of industry and Government,- said Charles Rossotti, senior partner at Carlyle. -We have invested in Command Information to help organizations realize the benefits that come from this next generation technology."

In a move to quickly expand its delivery capabilities, Command Information this week also merged with Digital Focus (www.digitalfocus.com), a leader in Agile software development and integration services. For a decade Digital Focus has provided software development, agile coaching, and IT consulting services to Fortune 1000 and medium-sized businesses, including one of the country-s largest Internet service providers and Web portals. The merger gives Command Information the capability to deliver working software for clients that leverage the new features and functions of IPv6, while meeting organizational needs. With more than 75 employees, post-merger the company will continue operating as Digital Focus, a Command Information company.

-Our merger with Command Information will create the first entity designed to address a company-s entire IPv6 migration,- said Dianne Houghton, CEO of Digital Focus. -Tom Patterson, Jim Ungerleider and the entire Command Information leadership team bring a wealth of expertise in Internet technology to complement our talent at Digital Focus.-

Tom Patterson, chief executive officer and former chief strategist of e-Commerce at IBM, will guide the new company-s overall strategy and business development. Jim Ungerleider, a former executive with American Management Systems, will serve as president and chief operating officer of the new Herndon, VA-based company.

Command Information (www.CommandInformation.com) provides services and solutions in the six critical business areas affected by the IPv6 migration, including:

- IPv6 strategy

- application development

- application and infrastructure security

- mobile convergence and telematics

- business and information strategy

- network architecture and implementation.

Command Information Merges With Digital Focus/2

-IPv6 will have a dramatic impact in corporate security, mobility, supply chain management and other key business functions worldwide,- said Patterson. -We believe that to really help organizations leverage this new technology, we need to incorporate great companies like Digital Focus that can deliver real results for our clients.

the carlyle group

|

|

Brooke B. Coburn - Managing Director, The Carlyle Group - on the Board of Command Informations

The Command Information leadership team is dedicated to helping organizations leverage the changes of IPv6 - a common mission that guides us in our strategies, solutions, and client service experiences.

Brooke B. Coburn is a Managing Director focused on early- and growth-stage investments, and small leveraged buyouts, in the U.S. telecommunications, media, technology and business services sectors. He is based in Washington, DC.

Since joining Carlyle in 1996, Mr. Coburn has been actively involved with the firm's investments in Bredband (B2), CityNet Telecom (merged with Universal Access), Core Location (acquired by El Paso Global Networks), DigiPlex S.A., Genesis Cable (acquired by Benchmark Communications), Matrics Technologies (acquired by Symbol Technologies), Neptune Communications (acquired by Global Crossing), NorthPoint Communications, Pacific Telecom Cable, Prime Communications (acquired by Comcast), Sonitrol Holding Corp., WCI Cable and Wall Street Education.

Prior to joining Carlyle, Mr. Coburn was with Salomon Brothers, Inc. where he focused on M&A and capital raising assignments in the Media & Communications Group.

Mr. Coburn received his A.B. from Princeton University with honors.

Mr. Coburn is on the Board of Directors of BNX Systems, Matrics, Inc., Sonitrol Holding Corp., LLC, WCI Cable, Inc. and Wall Street Education.

|

|

this from Command Informations site:

Leveraging IPv6

The Internet is the most significant technological advancement of the information age. It powers industry, drives commerce, helps us communicate, and stands as the greatest repository of knowledge in the history of mankind - and it is all built on a protocol that was developed over 30 years ago.

IPv6 is the next generation Internet protocol - designed with superior scalability, reliability, flexibility and security. Under development since the mid 90-s, IPv6 is now ready for deployment across the globe and is changing the very foundation of the Internet.

Why do we need IPv6-

Internet protocol employs a series of hosts that collaborate to transmit data via the Internet. Devices connected to a network, whether a local area network (LAN) or the Internet itself, receive Internet protocol numbers-essentially a kind of virtual address that uniquely identifies each device.

In its current form, Internet protocol (IPv4) can accommodate four billion unique addresses. While that sounds substantial, the practical number of usable addresses is actually much lower. This restriction is quickly becoming an unacceptable burden for today-s applications. In fact, none of the information packets transmitted today are guaranteed to reach their specific destinations in original condition. To account for that shortcoming, other protocols are often simultaneously used to augment the transmission and ensure data integrity - often with limited success.

IPv6, on the other hand, would support unique addresses well beyond the trillions, two to the one-hundred twenty-eighth power. To get a sense of the actual amount, imagine a three with 39 zeroes behind it. IPv6 will not only eliminate the shortcomings of IPv4, but unlock new products and services that were previously unthinkable.

The appeal of an Internet protocol with essentially limitless addresses is that it will easily support the inevitable proliferation of personal wireless devices. Four billion addresses were once enough because they were intended for computers alone. Today, and in the years ahead, there will be dozens, if not hundreds of devices for each and every potential Internet user. That explosive growth demands the effectively incalculable depth of addresses only available from the improved Internet protocol, IPv6.

Why is IPv6 critical to my organization-

Organizations are turning to IPv6 to bolster their competitive position in the global marketplace. IPv6 will significantly improve capabilities in security, privacy, location-based services, networking, and mobility to open up new areas of business solutions that were previously impossible, and indeed allow the development of advanced applications that cannot yet even be imagined.

IPv6-enabled organizations will be able to support:

Virtual Private Networks that keep information safe and secure no matter where the employee goes or what device they use for access.

Customer Relationship Management systems that not only know who a customer is, but also where they are.

Supply Chain Management systems that allow for easier integration and tracking of products throughout the world.

Privacy policies that can be effectively enforced.