|

Terence Corcoran:

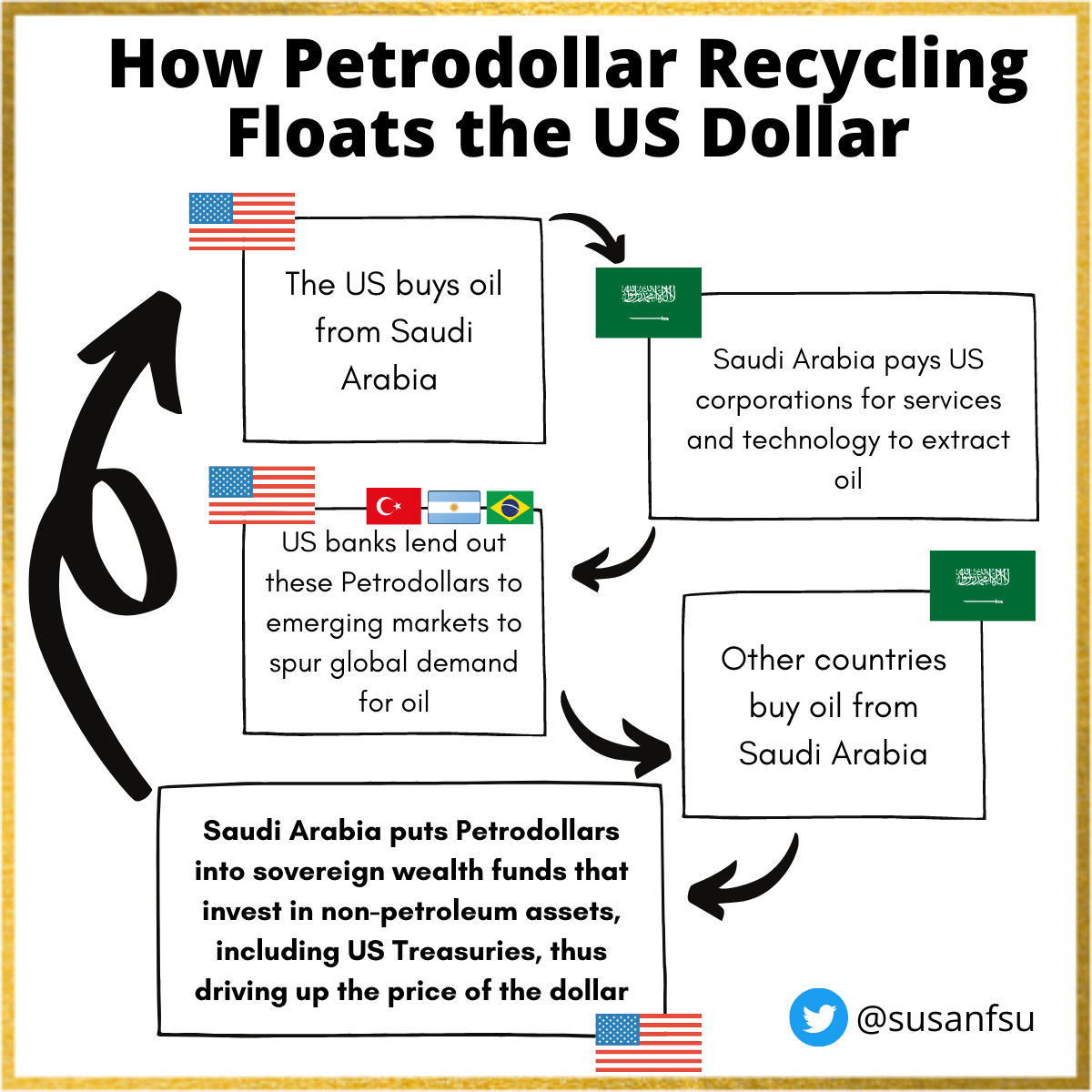

In Germany, the government closed nuclear power stations and elected to adopt natural gas as a key energy source, claiming it represented "an important bridging technology on the way to greenhouse gas neutrality." A new pipeline from Russia was intended to provide the gas. But then came Vladimir Putin.

Hailed in 2017 (?) by World Economic Forum leader Klaus Schwab as a Young Global Leader, Schwab later introduced Putin to a 2021 WEF audience as the voice of non-confrontation in this new world. "At this moment in history," said Schwab, "where the world has a unique and short window of opportunity to move from an age of confrontation to an age of co-operation, the ability to hear new voices, the voice of the president of the Russian Federation is essential, even and especially in times characterized by differences, disputes and protests."

Putin's WEF speech zoned in not on his Ukraine strategy but on the risks posed by COVID-19 to global stability. He seemed to be blaming the pandemic for rising global tensions. "The coronavirus pandemic has become a major challenge to mankind, and it has accelerated structural changes, the preconditions for which were already in place."

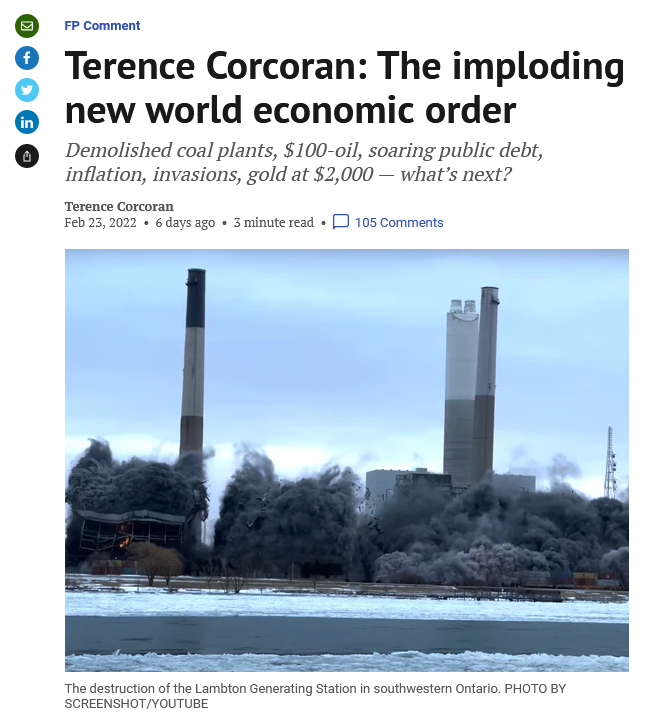

In retrospect, Putin was using the COVID crisis as a scene-setter for his larger ambitions. Russia's moves this week to annex the Ukraine have forced Germany to reverse its approval of the Nord Stream 2 gas pipeline from Russia. Having figuratively imploded nuclear plants, Germany now will have to blow up its new gas pipeline, although nothing is certain. Germany needs the gas; Russia presumably needs the revenues.

In the last two years, mired in climate and pandemic policy, Germany, the United Kingdom and most of Europe have been sliding into an energy and economic crisis, pushed along by the climate NetZero 2050 fantasy of a power system driven by renewables and natural gas. Coal and nuclear plants are being closed, creating energy price chaos â€'� except in China and other coal-dependent nations.

|

Russian Oligarchs Slam Russian Invasion

|