|

|

United States Patent

5,878,155

March 2, 1999

Method for verifying human identity

A method is presented for facilitating sales transactions by electronic media. A bar code or a design is tattooed on an individual. Before the sales transaction can be consummated, the tattoo is scanned with a scanner. Characteristics about the scanned tattoo are compared to characteristics about other tattoos stored on a computer database in order to verify the identity of the buyer. Once verified, the seller may be authorized to debit the buyer's electronic bank account in order to consummate the transaction. The seller's electronic bank account may be similarly updated.

|

|

| Flashback to 2002: Spielbergs 'Minority Report'

Pre-Crime

There is on the drawing board a device which automatically processes live pictures from closed circuit cameras and, from the body movement, sounds an alert when it detects that someone in the picture might be about to commit a crime.

While the new film Minority Report portrays a future where people are arrested before they commit crimes - the reality is that advances in genetics, and the processing of personal data, and, yes, CCTV are opening up some of those possibilities in the present.

BBC

|

|

|

Peter Schwartz, an internationally renowned futurist and business strategist is co-founder of Global Business Network in Emeryville, CA and the author of two books. He lectures and consults around the world regarding future trends and served as a consultant for the movies Deep Impact, War Games and Sneakers and was a script advisor to Steven spielberg on the film, Minority Report.

according to Schwartz:

|

|

People will live longer and be healthier, expect 100 to 150 years of age to be common. We will learn to prevent many diseases and regenerate body parts.

The end of retirement is upon us. People will have multiple careers and be able and want to work to a much older age than is customary today.

The US population will be more diverse in the future. We will continue to see waves of immigrants, primarily of Asian and Spanish descent.

At UC Berkley, 45 percent of the entering class in 2003 is of Asian descent; these are our future business and government leaders.

Since 1992 in California, the state has opened one new classroom per day.

America is still young, compared to other countries. Our population is and will continue to be vigorous and healthy which provides a good base for workers and soldiers. In contrast, Europe has an aging and shrinking population that will need to be taken care of, rather than produce goods and services.

There has been a movement out of poverty during the last 50 years and there is no reason this shouldn't continue. With the current rate of growth in individual income, in 2054 our population will be twice as rich as it is today. We won't eliminate poverty, but more people will see a rise in their income and net worth and there will continue to be boom and bust cycles.

Even though manufacturing jobs and plants are being eliminated today, as robotic and other technologies advance, manufacturing will return to the US (with fewer people involved). Technology will enable us to make things faster, cheaper and better than other less educated and technologically advanced countries.

A global middle class of 2 to 3 billion people will develop as China and other countries see increases in productivity and wealth.

Expect to see a tremendous growth of talent and population in major metropolitan cities of the country. These are great places to live today and that will remain constant in the future.

|

We will be connected. You will be able to reach anyone, anytime, anyplace and we will give up some privacy for this capability.

Biotechnology will bring us new, efficient and clean ways to manufacture items, much as nature makes thing now. We will design and build things from the bottom up, one atom at a time.

These new manufacturing processes will be 1000s of time more efficient than they are today and generate no pollution.

Manufacturing will be cleaner, greener, and more productive.

Buildings, fashions, icons and designs will remain stable and endure, but continue to evolve. Cities and buildings will be layered in time, in that older buildings that are 100 years old will be remodeled and exist next door to new modern structures.

Keyboards and wires will disappear; other forms of interaction with computers, buildings, and vehicles will be developed that are less intrusive and obvious. Examples include gestural, voice and other types of interfaces.

We will still have run-down neighborhoods, a drug problem and crime.

Some city icons (locations and buildings) will be frozen in time, the White House, the Space Needle; distinct and recognizable buildings will endure.

Expect to see more personalized communication and data flow. You will get your news real time, however you want it, wherever you are. The electronic books and newspaper will be reality and give you real time updates as things happen right in front of your eyes.

Hydrocarbon fuels will become obsolete and be replaced by clean hydrogen powered fuel cells.

Expect big advances in biotechnology, including the ability to control plant and animal evolution at the atomic and molecular level. There will be hybrid crosses between animal and plant species.

Nano and micro robotic technology will become a reality that impacts all aspects of our life.

- source

|

|

incidently - Global Business network have ties to the Tides foundation, The Rockerfeller Foundation

members write for outlets such as 'wired' and seem to justify several major foreign policy drives:

In "Nuclear Now" (Wired, February 2005), GBN Founder Peter Schwartz argues that the urgent and serious consequences of climate change require a renewed and major investment in nuclear power.

This policy is being pushed right now by the G8 power elite...as a new global energy policy which also seeks to implement a new era of Nuclear proliferation

|

|

The cashless, cardless society

by Chris Skinner

He is a director of TowerGroup and founder of ShapingTomorrow.com

[which is Headed by 'Futurist' Mike Jackson]

During the last decades we have seen several technology revolutions. The 1980's introduced the personal computer, the 1990's the internet and the 2000's the iPod. Chris Skinner ponders the next wave of technological innovation and its likely impact on the banking community. The speed at which revolutions take place is collapsing. The television took three decades to become accessible whilst the iPod took about three months. The digital generation is rapidly and radically re-landscaping markets from music to travel to fashion to entertainment to banking. All of which is made viable by the Internet and mobile connections.

These days, in our constantly connected global society, new ideas and innovations can spark new ways of doing business within months. The result is that we are living in a state of flux which is leading to a cashless, cardless society.

Now, many of you will stop reading at this point because you think a cashless, let alone cardless, society is a fallacy. A cashless society is like a clothless suit - it is the Emperor's new clothes. Everyone can talk about the idea of a cashless society but, in reality, there's nothing there. However, we were living in a cardless society only fifty years ago.

It was not until 1958 that the credit card revolution occurred with the immortal 'Fresno Drop'. The Fresno Drop was conceived by a middle manager at the Bank of America named Joe Williams. Mr. Williams mailed out 60,000 credit cards to nearly every household in Fresno in 1958. The result was that the BankAmericard became a success and the credit card became a routine part of our daily lives.

So it took about three decades for the credit card to become accepted and another two for it to become the major retail payment mechanism in most countries. How long for it to disappear? Maybe a decade? And the same goes for cash too.

What are the signs that this may happen? There are many. Here's the logical progression.

To begin with, cash usage in America has halved in the last eight years, from 60% of all payments to 31%. The same is true with cheque usage, halving from 30% of all payments to just 15%. The reason for the big drop is the fast rise of debit and credit card payments, rising from 10% to 51% of payments. This points to a cashless society being made possible by substituting cash with cards.

The rest of this article will focus upon the signs of change that point to the ultimate replacement of cards.

The first of those signs is the increasing use of mobile telephones for small value payments. Mobiles are paying for lots of things from car parking meters to taxi fares to drinks and snacks from vending machines. You only have to visit Finland, Japan or Australia to see folks text messaging machines with payments.

In particular, Japan's NTT DoCoMo has made a business out of mobile payments with the i-mode mobile entertainment system, which gives access to Internet, 3G and other services. The result of increasing functionality on the phone has been a massive upsurge in spending on games, ringtones and other services through the phone. i-mode is now available in Japan, Germany, the Netherlands, Taiwan, Belgium, France, Spain, Italy, Greece, Australia, the UK, Israel and Russia and services are being continually enhanced in terms of range and functionality. The result is that mobile payments are becoming a standard for not just ringtones and games, but music, Internet orders and a variety of other payments.

That leads to the second sign of change - the fact that payments are now sliced and diced. It used to be that we would only pay for things if they were 1.99, 11.99, 99.99 or any other amount with a .99. The fact is that the amount today is just the .99. Everything from i-tunes to i-mode prices access at a fraction of a cent and can support that micropayment transaction level because the amounts are being treated like airtime on the mobile. Just as you pay a fraction of cent for a fraction of a phone call, so you can now pay a fraction of a cent for a fraction of a tune.

As a result, TowerGroup expects the total market for micropayments in the USA to reach $11.5 billion by 2009, with almost $5 billion being made by mobile phones. The mobile, internet and micropayment world of the future will not be fuelled by cards and cash but by clicks and texts.

That leads to the third revolution in payments - waves. Rather than signing, clicking or texting, just wave your card at a payment station using Radio Frequency Identification and Near Field Communication. Both are chip-based contactless payments systems that allow a card or other payments device, such as a mobile phone, to be uniquely recognised by a reader. Currently, such chips are used primarily for tagging your dog or cat at the vet but they are being introduced extensively by the card infrastructure providers of Visa, MasterCard and American Express, as well as by other card providers and issuers such as JP Morgan who launched the Blink card as a contactless device to their 94 million American cardholders this year. All of these contactless payment systems are based on a credit, debit or prepaid card being loaded with value such that when you reach the purchase station you just wave the card over the station and you have paid.

There are several things that concern me when it comes to contactless, mobile and micro payments however. In particular, the fact that most banks do not appear to take these developments seriously. Banks view mobile and micropayments as 'wait and see' pilots and trials, whilst many of the mobile and micropayment leaders are telco's such as NTT DoCoMo or innovators like PayPal. The same is true with the innovations in contactless payments.

For example, the Oyster card was introduced to London as a rechargeable contactless prepaid card in 2003. It originally targeted London's rail and subway users with lower cost fares and, as a result, has been a runaway success with over 2 million users today. The use of the card is now extending to pay for traffic meters, newspapers, burgers and chewing gum. In fact, it will soon become a real substitute for cash and therefore the use of cash will decline further whilst the use of the card will increase.

But the vision for this type of contactless card does not stop there. The Oyster card is likely in fact to follow the example of the Octopus card in Hong Kong. The Octopus card was launched back in 1997 and has over 12.5 million users today. Not only can the card be used for payments across a broad spectrum of retailers, but it is even usable in Bossini as from August 2005. Bossini is the equivalent of a Marks & Spencer or LL Bean agreeing to accept the card. Now, you have a real alternative to both cash and credit and debit cards - the contactless rechargeable payments card from the local transport system.

Mobile, micro and contactless payments are in fact disruptive technologies in the payments world. Disruptive technologies were identified by Clayton Christensen in his book, The Innovator's Dilemma. Mr. Christensen talks about disruptive technologies as often being a cheap alternative to an existing product. The alternative is often a no-frills, stripped-down, basic option to the incumbent product which, as a result, is dismissed as cheap rubbish by the existing providers. However, as the cheaper alternative gains market traction, it also gains investment dollars and uses those investment dollars to upscale and ultimately challenge the incumbent providers.

One of the examples Mr. Christensen uses to illustrate this is the Japanese car manufacturers. When Japan entered the US car market in the 1950's, the cars were dismissed as irrelevant by Chrysler and Ford as they were cheap, rusty, poor quality and unfashionable. However, for people with a limited budget who just wanted a car to go from A to B, these new cars were ideal; affordable, comfortable and nowhere near as hard to acquire as an American car. Over the years, Honda and Toyota garnered more demand and upscaled until they became the most popular cars in the USA.

That is a disruption and we are seeing these disruptions in the payments world. There are many simple methods of making low value payments, each of which could, over time, upscale to higher value payments. For example, telecommunications firms focusing on mobile payments; online organisations such as PayPal taking a large slice of Internet micropayments; payment providers from the transport systems, such as Octopus and Oyster, offering electronic cash systems that are slowly upscaling from paying a fare to buying a burger to purchasing clothing. All of these mobile, micro and contactless payments are convenient and easy for consumers and have the potential, over time, to upscale. But upscale to what?

This leads me to the second concern with mobile and contactless payments, which is that banks believe this is just for low value payments.

Currently, most mobile payments are for items under $10 and contactless payments for items under $100. What prevents these systems offering payments for higher value items is that there is no authentication of the payment. Unlike, card-based payments where you need to carry something you have - the card - you also need to present something you know - the PIN or signature. It is the second piece that allows higher value retail payments today. Without a second authentication mechanism, mobile and contactless payments will be restricted, but adding these verification mechanisms - PIN or signature - would defeat the reason for introducing these payment processes which is speed. The fact that contactless payments take 20 seconds off traditional payment times is the reason for its success in fast food restaurants, cinemas and subway stations. Add extra time onto the transaction and that defeats the purpose.

However, you would expect to take longer over a $1000 transaction than you would over a $1 transaction. Therefore, if you could bring in a second level authentication to the payment instrument then it could easily replace existing Chip and PIN and signature systems. That is where the importance of biometrics comes into focus.

Biometric payments will maintain the speed of transaction whilst allowing high value payments based upon something you are, which is more secure than something you have or something you know. At present, biometric payment systems are few and far between but that could all be about to change.

The very fact that governments have focused upon tightening border security through biometric programmes is the key to unlocking this potential authentication tool. As you pass through US customs today, you give your fingerprints and face for biometric authentication. Soon, in the UK, all citizens will be issued with biometric identification cards if the government achieves its aims. In the Netherlands, people are proactively signing up to the Schiphol airport iris recognition Privium service. The reason is that it allows you to queue jump customs and walk straight through to your flight.

As governments force biometric programs into their countries, so will banking and payments piggy-back on this change. The reason, if for no other, will be to address the fraudulent activities in banking today. For example, the major inhibitor to online transactions is the fact that many consumers feel threatened by identity theft and online fraud. In particular, the media has done a good job of getting people concerned about these activities with reports of over 100,000 victims of identify theft in the UK in 2004 costing a total of £1.3 billion in losses. It takes up to six months for an identity theft victim to sort out the issues and nine out of ten victims think the fear the theft created for them will never end. On the other hand, one in five people throw out their bank statements and utility bills without giving a second thought to the potential dangers.

In particular, many of us know that usernames and passwords do not work. Many of us write passwords down on post-it notes that are left on the desk or in drawers, and one in five of us use the same password for everything. So how secure is online banking when your customers use the same password to access their account as they do to order a book from Amazon? The result is that almost half of the customers of banks would think about switching to an alternative financial services provider if they offered stronger authentication. Usernames and passwords, signatures and Chip and PIN will never be completely fraud-proof because they rely upon something you have and something you know, both of which can easily be usurped or stolen.

That is why many see the future of authentication being based upon something you are - your face, iris, finger or palm. That is why governments are introducing biometric border controls and, as a result, banks will do the same. This means that you now have a variety of developments that physically displace cash - mobile, micro and contactless payments - which can also be used for higher value payments when they are combined with biometric authentication.

If you agree with the hypothesis presented so far, then you have agreed that we could move to a cashless society, with most cash payments being replaced by cards and mobile. So what about becoming cardless? It will be a decade or so before cards disappear due to convenience and lifestyle.

Imagine that your payment mechanism is built into a watch that your bank gave you. The watch includes an RFID or NFC capability, biometric recognition and is supported by existing infrastructures at the merchant front-end and money transmissions process back-end. The retail consumer can therefore go into any store, wave their watch at the contactless terminal, press their finger to the pay point and they have purchased the goods. No card or cash involved.

That is the vision of the future of retail payments and we are almost there today. We already have contactless payment terminals, fingerprint recognition payments, micro and mobile payments. The only logical step is to introduce non-card based payment systems.

Some of these already exist, like the Exxon SpeedPass keyfob - an RFID chip based contactless payment system in the USA for gas. Or the JCB Credit Card Casio Watch - yes, you can already pay for goods with a wave of your watch if you are a JCB credit card holder in Japan. It will not be long before the card evolves to the clothing or jewellery of your customer base.

Therefore the near-term world of retail payments will be one of a cashless and cardless society. A society based upon micro and macro contactless payments with biometric secure authentication through bank provided mobile and wearable devices. All of this may be a long stretch from where we are today, but the concept of a non-card based cashless society is already being trialled in Scandinavian countries, Asia and other innovative towns and cities across the world. It is only a matter of time before we see such capabilities delivered across Europe and America.

The focus will be convenience and cool. Give your customers trend-setting payments devices rather than coloured cards. Deliver cashless solutions and infrastructures rather than notes and coins. Dump the gold or platinum card for the gold or platinum ring. Develop the mobile wallet with free phone, iPod, 8 megapixel camera and 3G.

All sound a bit too visionary? A bit too quirky? Well just watch out. As Clayton Christensen can testify, the winners will be the ones who disrupt payments because they have a vision of the long-term. The losers will be those who think these innovations are meaningless.

|

The Mark of the Beast? or just an old Nazi plan revamped?

|

US privacy campaigners fear mark of the beast

James Sturcke Wednesday April 26, 2006 - The Guardian

A decision by the Bush administration to proceed with what is believed to be the largest radio frequency tagging programme in history has triggered protests from US privacy campaigners. The US department of agriculture (USDA) wants to keep track of all livestock production and movements in what it claims is an attempt to improve the traceability of disease outbreaks. By 2009, 40m cattle will have been tagged, and the scheme is to be extended to include the billions of chickens and other animals farmed every year in the US.

But campaigners are outraged that all agricultural producers, including smallholder farmers, are being pressured into registering their details when the national animal identification system (Nais) becomes fully operational in 2009. They also fear that the technology earmarked for the scheme could be used on people.

"This is the biggest scheme of its kind," said Katherine Albrecht, a consumer privacy expert. "They say it is aimed at tracking animal disease outbreaks, but I have had conversations with public health officials where they have been looking forward to a time when the spread of human diseases could also be monitored in this way."

Although the USDA insists the programme is "technology neutral", and various schemes, such as retina scans and DNA testing, could be used in it, campaigners believe radio frequency identification (RFID) will predominate. RFID involves a chip that is scanned by a reader in a way similar to the operation of the Oyster card ticket system on the London underground. Firms tracking components and stock as they move around the world are increasingly using the technology, but it has caused alarm among civil liberty campaigners, who believe it will also enable organisations to monitor the movement of people.

"It raises issues not just about the movement of products but about watching people's lives," Ms Albrecht said. "We are not a long way off from people beginning to demand publicly that systems be used on humans." "I know that many people believe this is the best way to trace animal diseases. However, there are other people with alternative agendas. They are not talking or thinking enough about the long-term impact or the bigger picture: if you do it to animal diseases, the next step is humans. I believe we are on the verge of the next step."

She cited as evidence the decision last year by a former US health secretary, Tommy Thompson, to join the board of Verichip, a Florida-based firm that makes human RFID tags. Soon after taking the job, Mr Thompson announced he would have a rice-sized VeriChip RFID tag implanted under his skin. The firm's website states that the technology could have medical applications, with paramedics instantly able to call up the records of unconscious, but tagged patients. Earlier this month, the US agriculture secretary, Mike Johanns, announced the Nais implementation plan.

"Developing an effective animal identification system has been a high priority for USDA, and we've made significant strides towards achieving a comprehensive US system," he said. He announced that the plan "set an aggressive timeline for ensuring full implementation of the Nais by 2009".

The animal-tracking databases will record and store animal movements, providing animal health officials with data they will use in fighting outbreaks of livestock disease. Their aim is to identify the origins of an outbreak within 48 hours. The plan involves registering properties where farm animals are kept, initially on a voluntary basis. However, the USDA says it "may move toward a requirement for mandatory premises and animal identification for all species included in the system". Plans are currently being developed for cattle, swine, sheep, goats, horses, poultry, bison, llamas and alpacas, among other animals, to be tagged.

Around 35m cattle and 8bn poultry are slaughtered in the US every year. Under the scheme, some animals would need individual tags while others would be tagged as a group. The plans have triggered protests from small farmers across the US, who have used a website to voice their fears of invasions of privacy, increased food prices and concentration of power in the hands of large producers.

|

Announcement at global security confab

unveils syringe-injectable ID microchip

Posted: November 21, 2003

By Sherrie Gossett

At a global security conference held today in Paris, an American company announced a new syringe-injectable microchip implant for humans, designed to be used as a fraud-proof payment method for cash and credit-card transactions. The chip implant is being presented as an advance over credit cards and smart cards, which, absent biometrics and appropriate safeguard technologies, are subject to theft, resulting in identity fraud. Identity fraud costs the banking and financial industry some $48 billion a year, and consumers $5 billion, according to 2002 Federal Trade Commission estimates.

In his speech today at the ID World 2003 conference in Paris, France, Scott R. Silverman, CEO of Applied Digital Solutions, called the chip a "loss-proof solution" and said that the chip's "unique under-the-skin format" could be used for a variety of identification applications in the security and financial worlds.

The company will have to compete, though, with organizations using just a fingerprint scan for similar applications.

The ID World Conference, held yesterday and today at the Charles de Gaulle Hilton, focused on current and future applications of radio frequency identification (RFID) technologies, biometrics, smart cards and data collection.

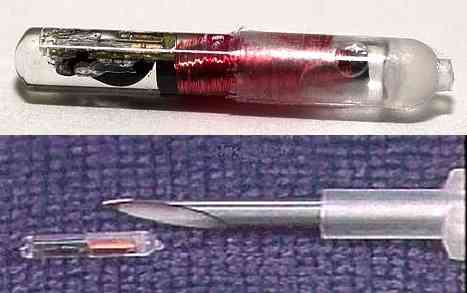

The company's various "VeriChips" are RFID chips, which contain a unique identification number and can carry other personal data about the implantee. When radio-frequency energy passes from a scanner, it energizes the chip, which is passive (not independently powered), and which then emits a radio-frequency signal transmitting the chip's information to the reader, which in turn links with a database.

ADS has previously touted its radio frequency identification (RFID) chips for secure building access, computer access, storage of medical records, anti-kidnapping initiatives and a variety of law-enforcement applications. The company has also developed proprietary hand-held readers and portal readers that can scan data when an implantee enters a building or room.

The "cashless society" application is not new – it has been discussed previously by Applied Digital. Today's speech, however, represented the first formal public announcement by the company of such a program.

In announcing VeriPay to ID World delegates, Silverman stated the implant has "enormous marketplace potential" and invited banking and credit companies to partner with VeriChip Corporation (a subsidiary of ADS) in developing specific commercial applications beginning with pilot programs and market tests.

Applied Digital's announcement in Paris suggested wireless technologies, RFID development, new software solutions, smart-card applications and subdermal implants might one day merge as the ultimate solution for a world fraught with identity theft, threatened by terrorism, buffeted by cash-strapped governments and law-enforcement agencies looking for easy data-collection, and corporations interested in the marketing bonanza that cutting-edge identification, payment, and location-based technologies can afford.

Cashless payment systems are now part of a larger technology development subset: government identification experiments that seek to combine cashless payment applications with national ID information on media (such as a "smart" card), which contain a whole host of government, personal, employment and commercial data and applications on a single, contactless RFID chip.

In some scenarios, government-corporate coalitions are advocating such a chip be used by employees also to access entry to their workplace and the company computer network, reducing the cost outlay of the corporations for individual ID cards.

Malaysia's "MyKad" national ID "smart" card is the foremost example.

Meanwhile, privacy advocates have expressed concern over RFID technology rollouts, citing database concerns and the specter of individuals' RFID chips being read without permission by people who have their own hand-held readers.

Several privacy and civil liberties groups have recently called for a voluntary moratorium on RFID tagging "until a formal technology assessment process involving all stakeholders, including consumers, can take place."

Signatories to the petition include the American Civil Liberties Union, the Electronic Frontier Foundation, the Electronic Privacy Information Center, Privacy International and the Foundation for Information Policy Research, a British think tank.

Commenting on today's announcement, Richard Smith, a computer industry consultant, referred to what some "netizens" are already calling "chipectomies": "VeriChips can still be stolen. It's just a bit gruesome when to think how the crooks will do these kinds of robberies."

Citing MasterCard's PayPass, Smith pointed out that most of the major credit-card companies are looking at RFID chips to make credit cards quicker, easier, and safer to use.

"The big problem is money," said Smith. "It will take billions of dollars to upgrade the credit-card networks from magstripe readers to RFID readers. During the transition, a credit card is going to need both a magstripe and an RFID chip so that it is universally accepted."

Some industry professionals advocate having citizens pay for combined national ID/cashless pay chips, which would be embedded in a chosen medium.

Identification technologies using RFID can take a wide variety of physical forms and show no sign yet of coalescing into a single worldwide standard.

Prior to today's announcement, Art Kranzley, senior vice president at MasterCard, commented on the Pay Pass system in a USA Today interview: "We're certainly looking at designs like key fobs. It could be in a pen or a pair of earrings. Ultimately, it could be embedded in anything – someday, maybe even under the skin."

source

|

Injectable chip opens door to 'human bar code'

Charles J. Murray PlanetAnalog (01/04/2002)

Radio-frequency identification chips, which have found a home in applications ranging from toll road passes to smart retail shelves, may be close to taking up residence in the human body.

A Florida-based company has introduced a passive RFID chip that is compatible with human tissue, and the developer is proposing the chip for use on implantable pacemakers, defibrillators and artificial joints. The company, Applied Digital Solutions (Palm Beach, Fla.), also said that the chip could be injected through a syringe and used as a sort of "human bar code" in security applications.

Called the VeriChip, the device could open up a broad new segment for the $900 million-a-year RFID business, especially if society embraces the idea of using microchips for human identification. Applied Digital executives ultimately believe that the worldwide market for such implantable chips could reach $70 billion per year.

"The human market for this technology could be huge," said Keith Bolton, senior vice president of technology development at the company.

Futurists agree that the idea of using microchips inside the body could ultimately represent a large market opportunity, but they doubt whether this initial effort will have a significant effect on the RFID market.

"Are we going to see chips embedded in the human body? You bet we are," said Paul Saffo, a director of The Institute for the Future (Menlo Park, Calif.). "But it isn't going to happen overnight."

Pacemaker helper

Still, Applied Digital Solutions' executives are preparing to sell between $2.5 million and $5 million worth of VeriChips in 2002. The company initially plans to sell the chips in South America and Europe for use with pacemakers and defibrillators. In that application, it could be attached to the outside of the heart device or implanted nearby in the body. Doing so would enable medical personnel to identify and monitor a patient's implanted devices merely by running a handheld scanner over the patient's chest.

"If you're a pacemaker user and you're in an accident and in shock, an ambulance attendant could scan the body and retrieve information about the device," Bolton said. "The chip could provide information about the pacemaker's settings, who its manufacturer is and whether you have any medical allergies."

The company said it is working with makers of implantable pacemakers and defibrillators to incorporate the chip during the equipment-manufacturing process.

Applied Digital Solutions is awaiting approval from the U.S. Food and Drug Administration and does not expect to sell the chips in the United States until that approval is granted. The company's engineers said they expect approval later this year.

The announcement of the chip's availability created a media stir, however - not because of its potential use with pacemakers but because of its science-fiction-like potential application in human identification systems. Because the microchip and its antenna measure just 11.1 x 2.1 mm, Applied Digital Solutions said the assembly can be injected through a syringe and implanted in various locations within the body.

The tube-shaped VeriChip includes a memory that holds 128 characters of information, an electromagnetic coil for transmitting data and a tuning capacitor, all encapsulated within a silicone-and-glass enclosure. The passive RF unit, which operates at 125 kHz, is activated by moving a company-designed scanner within about a foot of the chip. Doing so excites the coil and "wakes up" the chip, enabling it to transmit data.

The chips are said to be similar to those that are already implanted in about a million dogs and cats nationwide to enable pet owners to identify and reclaim animals that have been temporarily lost. Applied Digital Solutions, which has made the pet-tracking chips for several years, says that the human chips differ mainly in the biocompatible coating that's used to keep the body from rejecting the implanted chip. The VeriChip is believed to be the first such chip designed for human identification.

Inspired by Sept. 11

In September, Applied Digital Solutions implanted its first human chip when a New Jersey surgeon, Richard Seelig, injected two of the chips into himself. He placed one chip in his left forearm and the other near the artificial hip in his right leg.

"He was motivated after he saw firefighters at the World Trade Center in September writing their Social Security numbers on their forearms with Magic Markers," Bolton said. "He thought that there had to be a more sophisticated way of doing an identification."

Applied Digital said Seelig, who serves as a medical consultant to the company, has now had the chips implanted in him for three months with no signs of rejection or infection. Ordinarily, the company said, the chips would be implanted in a doctor's office under local anesthesia.

Applied Digital's executives said the ability to inject the chips opens up a variety of RFID applications in high-security situations, as well other types of human identification systems. The chips, they said, could be implanted in young children or in adults with Alzheimer's disease, to help officials identify people who can't identify themselves. But the company is backing away from involuntary identification applications, such the tracking of prisoners or parolees. "We are advocating that this technology be totally voluntary," Bolton said.

Whether the technology will boost the market for RFID chips remains uncertain. Industry analysts had assumed that by now RFID would constitute a far larger market than its current, $900 million annual tally. A consortium of major manufacturers has sought to push the technology as a replacement for bar codes in everyday products ranging from cereal boxes to shaving cream cans, but the cost hasn't dropped low enough to make that feasible. More recently, a group led by the European Central Bank began work on embedding RFID chips in the euro bank note, but the chip category has yet to find its killer app.

Applied Digital nonetheless has high hopes for its RFID technology. The publicly held company's stock did not fare well last year, plummeting from a high of $3 a share on Feb. 7 to 11 cents per share on Sept. 17. But its per-share stock price jumped to 50 cents from 38 cents after the company announced the VeriChip.

Eventual adoption

Analysts expressed confidence that the concept would eventually be adopted but were skeptical about its immediate future. "For this to work, you are going to need a standard that everyone agrees to," said Saffo of The Institute for the Future. "Then you have to convince people to buy reading devices that may be fairly costly."

Applied Digital's engineers would not say how much the chips or handheld readers might cost. The company's reader is a proprietary unit that is required for use with the VeriChip. Some further suggested that the chip might be too large for easy adoption.

Veterinarians who have implanted the chips in dogs and cats say that the techniques used in animals are unlikely to be embraced by humans. "The needle is huge," said Dean Christopoulos, a veterinarian in Des Plaines, Ill. "It's almost as thick as your pinky."

Some engineers suggested the technology might ultimately be scaled down, making the chip's acceptance more likely. At Alien Technology Corp. (Morgan Hill, Calif.), engineers have already discussed using that company's ultrasmall RFID chips in human applications. Alien, which uses a process known as fluidic self-assembly to create chips measuring 350 x 350 microns, has demonstrated its 900-MHz technology on everyday products such as soap and shampoo bottles. The coded information can be detected and read across distances measuring almost 3 feet.

"There are companies making RFID tags that are much smaller than a couple of millimeters," said Andy Holman, director of business development for Alien Technology.

Analysts also suggested that human identification technology would be more likely to be popularized when engineers are able to integrate more memory and other features, such as global-positioning satellite units and induction-based power-recharging techniques. GPS might help find lost children and adults, they said, while larger memories would enable doctors to store vital patient information.

The concept "goes all the way back to the 1960s," said Jerry Krasner, vice president of market intelligence for American Technology International Inc.'s Embedded Forecasters Group. "What's new is the ability to store a lot of data.

"As soon as you can do that, you'll see more applications for this type of technology," he said.

- eetimes.com

|

RFID Used to be just for Pets...NOW IT'S YOUR TURN -

First, they came for the homeless

|

|

"Though the Radio Frequency Identification (RFID) tags set to be tested and surgically implanted below the skin by the U.S. Department of Health and Human Services in the homeless populations of New York, San Francisco, Washington DC and Bethlehem, Pennsylvania are not being used to insure killing as those in Logan's Run, they do turn the most vulnerable people in America into cattle, tagged and monitored like animals. Mandatory, compulsory and not a choice, the RFID tags are miniature radio transmitters the size of a matchstick inserted under the skin that enable police and government social programs to track and document the movements of homeless people electronically."

wiring our homeless

|

|

then they came for the 'foreigners'

|

Foregners: Radio technology eyed for U.S. borders

Weeding out potential terrorists, drug dealers and other criminals from shoppers, truckers and tourists who regularly pass through border crossings takes time. The RFID technology is designed to reduce the wait while giving authorities more information on who's coming into the country and who's leaving.

"We do not keep track of who enters this country," Hutchinson said while standing in an inspection booth at a crossing that is used each year by 5.4 million pedestrians and 3.9 million vehicles. "We need to have a comprehensive system, and that that's what our pilot (test) will do."

Currently, foreign visitors at the 50 busiest land border crossings in 10 states are fingerprinted as part of the government's new screening system. The system, called US-VISIT, scans photographs of the visitor's face and index fingers into a computer, which are matched with federal agencies' criminal databases.

With RFID technology, people or objects are identified automatically and swiftly. That allows vehicles outfitted with the technology to zip through toll plazas without stopping but won't at the border. People and vehicles still will have to stop, but if their identifying data produce no red flags, they will get just a cursory check rather than lengthy questioning.

The chip with the identifying information would be placed in a document, such as the State Department-issued border crossing cards for those who regularly make short trips across the Mexican border.

The chip is attached to an antenna that transmits a signal to a handheld or stationary reader, which converts the radio waves from the RFID tag into a code that links to identifying biometrical information in a computer database read by border agents. - Msnbc

|

Then they came for the children

Schoolchildren to be RFID-chipped

July 08 2004 - by Jo Best

Japanese authorities decide tracking is best way to protect kids

The rights and wrongs of RFID-chipping human beings have been debated since the tracking tags reached the technological mainstream. Now, school authorities in the Japanese city of Osaka have decided the benefits outweigh the disadvantages and will now be chipping children in one primary school.

The tags will be read by readers installed in school gates and other key locations to track the kids' movements.

The chips will be put onto kids' schoolbags, name tags or clothing in one Wakayama prefecture school. Denmark's Legoland introduced a similar scheme last month to stop young children going astray.

RFID is more commonly found in supermarket and other retailers' supply chains, however, companies are now seeking more innovative ways to derive value from the tracking technology. US airline Delta recently announced it would be using RFID to track travellers' luggage.

silicon.com

|

New Cell Phone Lets Parents Track Kids

BEIJING, July 29 (Xinhuanet) -- Parents in South Korea will now be able to track their children by using a device in a new mobile phone specially been designed for kids.

The colorful cell phone has antennas that look like human ears and a built in tracker using the global positioning satellite network, CRIENGLISH.com reported Wednesday.

The company claims the tracker will work even when the phone is turned off.

The phone has four buttons to save phone numbers of key contacts, such as Mom and Dad.

And just to keep the price down, the phones don't have text messaging or Internet capabilities. -

xinhuanet

|

then they came for the fashion conscious Youth

|

Big Brother promotes chips as a fashion accesory...

Finally: Proof that the drug 'ecstacy' makes you an idiot!

|

Clubbers choose chip implants to jump queues

11:12 21 May 04

Clubbers in Spain are choosing to receive a microchip implant instead of carrying a membership card. It is the latest and perhaps the most unlikely of uses for implantable radio frequency ID chips.

The Baja Beach Club in Barcelona offers people signing up for VIP membership a choice between an RFID chip and a normal card. VIP members can jump the entrance queues, reserve a table and use the nightclub's VIP lounge.

"The RFID chip is not compulsory," says Conrad Chase, managing director of the club. But he says there are advantages to having it. The obvious one is that you do not have to carry a membership card around with you, but also it means you can leave your wallet at home. This is because the RFID can be used as an in-house debit card, says Chase.

When drinks are ordered the RFID is scanned with a handheld device and the cost is added to your bill. The chips, called VeriChips, are produced by US company Applied Digital Solutions - New Scientists

|

Barcelona clubbers get chipped

Imagine having a glass capsule measuring 1.3mm by 1mm, about the size of a large grain of rice injected under your skin.

Implanting microchips that emit a Radio Frequency Identification (RFID) into animals has been common practice in many countries around the world, with some looking to make it a legal requirement for domestic pet owners.

[snip]

The chip is made of glass and is inert so there is no risk of it reacting with my body.

It sits dormant under the skin sending out a very low range radio frequency so it will not set off airport security systems.

The chip responds to a signal when a scanner is held near it and supplies its own unique ID number.

The number can then be linked to a database that is linked to other data, at the Baja beach club it make charges to a customers account.

- BBC

|

Note: Just imagine how many Trenchoat underground / Goths / Darkwavers would love to

receive the 'mark of the beast', just to piss their parent[s] off!!!

|

then they came for the Health conscious Nuclear Family

|

US family gets health implants

US doctors have implanted chips into the arms of a Florida family containing their medical histories in a controversial new programme that doctors hope may one day become standard practice.

The Jacobs' son - Derek - heard about the VeriChip from a television programme

The Jacobs family - Jeffrey, 48-years-old, Leslie, 46-years-old, and Derek their 14-year-old son - had the devices, about the same size as a grain of rice, implanted in a procedure that took only 10 seconds in a clinic in Boca Raton, Florida.

It is hoped the procedure could eventually replace medical alert bracelets and give medical personnel invaluable details into their patients' medical problems.

However the chips could also be used to contain personal information and even a global positioning device which could track a person's whereabouts, leading to fears the chip could be used for more sinister purposes.

- BBC

|

hey! don't worry the techno-theocracy have got it all sussed...

the childs toy can spy for you ...oh! and anyone else who can

hack in or utilise that secret backdoor in the chipset, of course!

|

Robots to Watch Children

The teddy bear sitting in the corner of the child's room might look normal, until his head starts following the kid around using a face recognition program, perhaps also allowing a parent talk to the child through a special phone, or monitor the child via a camera and wireless Internet connection.

The plush prototype, on display at Microsoft Corp.'s annual gadget showcase Wednesday, is one of several ideas researchers have for robots. The idea is to create a virtual being that can visit the neighboring cubicle for a live telephone chat even as its owner is traveling thousands of miles away, or let the plumber into the house while its owner enjoys a pleasant afternoon in the sun.

Plenty of companies are already building robots for the work place, and toy companies have created plush dolls that know a child's name or can incorporate other personal information. But Steven Bathiche, a research and development program manager with Redmond-based Microsoft, said his company's projects go further.

The "Teddy" project was one of about 150 projects on display at Microsoft's TechFest, a two-day event that gives Microsoft's worldwide team of researchers the chance to show product developers their sometimes far-flung creations, and perhaps find a fit for the projects in a future, marketable product.

- abcnews

|

remote control of your vehicle - are you next?

|

Police test hi-tech zapper that could end car chases

Ian Sample, science correspondent - Monday July 12, 2004

A hi-tech device that can bring speeding cars to a halt at the flick of a switch is set to become the latest weapon in the fight against crime.

Police forces in Britain and the US have ordered tests of the new system that delivers a blast of radio waves powerful enough to knock out vital engine electronics, making the targeted vehicle stall and slowly come to a stop.

David Giri, who left his position as a physics professor at the University of California in Berkeley to set up a company called ProTech, is developing a radio wave vehicle-stopping system for the US marine corps and the Los Angeles police department.

Tomorrow, at the Euroem 2004 science conference in Germany, Dr Giri will describe recent trials of the device. The tests proved that the system could stop vehicles from up to 50 metres away.

|

Now imagine the chip is inside you!

Monitoring and even regulating your Heart rate / Brain functions

Will they be able to Stop / control you with Radio Waves?

What about EMF / Radio signals from screens / Billboards?

|

|

The bulk of the device is designed to fit in a car boot and consists of a battery and a bank of capacitors that can store an electrical charge. Flicking a switch on the dashboard sends a burst of electricity into an antenna mounted on the roof of the car. The antenna then produces a narrow beam of intense radio waves that is directed at the vehicle ahead.

When the radio waves hit the targeted car, they induce surges of electricity in its electronics, upsetting the fuel injection and engine firing signals. "It works on most cars built in the past 10 years, because their engines are controlled by computer chips," said Dr Giri. "If we can disrupt the computer, we can stop the car." A prototype is due to be ready by next summer.

The Association of Chief Police Officers confirmed that researchers at the Home Office's police scientific development branch are testing a radio wave vehicle-stopping system. "There's a potential to use this type of device to stop criminals on the road. High speed pursuits are very dangerous, especially in built-up areas," said an association spokesman.

The Guardian

|

We are watching you...act NORMAL!!!

|

C.T.S -

combat zones that see...

CTS will record your action. Your face and license plate will likely

be matched to those on terrorist watch lists. Make a move considered

suspicious, and CTS will instantly report you to the authorities.

Noah Shachtman, Village voice

Dubbed Matrix, the database has been in use for a year and a half in Florida, where police praise the crime-fighting tool as nimble and exhaustive. It cross-references the state's driving records and restricted police files with billions of pieces of public and private data, including credit and property records.

Caught in the Matrix?

States' data project ignites privacy fears

|

|

Playing in the Lottery of death - armchair deathsquads

the remote control death sentence

The human Genome project has enabled everyone on the planet to be placed upon a database

which allows potential for the ultimate behavioral threat / weapon, one which eventually could target specific races and finally, individuals.

The entire Planet is being 'globalised into a Uber-capitalist Geo-behavioural command & control infrastructure

RFID is just the beginning in the quest for the Globally controlled shopping mall

|

|