Capt. Wardrobe - December 2021

|

To start with i'd like to round up a little on the Massive investment behemoth Vanguard - it's background, philosophy, intent.

Moving on to the

Social Credit System that was introduced in China and from that move into the proposals for different metaverse scenarios and what they might mean for a world that on the surface looks like it's politically polarised - but upon further inspection seems to be pushing the same totalitarian agenda, but from different points on the psuedo polemics of a politcally mapped out opposition. The Global Elite are the stakeholders.

The gamification agenda - unlocking of levels & the Level up conception; is being utilised in the pandemic and climate change narratives by the Elite classes...I look to ask ethical questions here about the ramifications of mixing gamification of social media & conversely; the social media-fication of gaming -: and to posit whether this is all a ruse to introduce social credit systems, by the back door to the west via a promulgated, designed, all encapsulating consumer tech-dystopia, and increasing politcization of the fear of disease (as of December 2021 Sars Cov 19) as a behavoural economic force multiplier for ever more invasive data collection & control. |

|

Until recently, it appeared economic competition had been driving the rise and fall of small and large companies across the U.S. Supposedly, PepsiCo is Coca Cola"s competitor, Apple and Android vie for your loyalty and drug companies battle for your health care dollars. However, all of that turns out to be an illusion.

Since the mid-1970s, two corporations — Vanguard and Blackrock — have gobbled up most companies in the world, effectively destroying the competitive market on which America"s strength has rested, leaving only false appearances behind.

Indeed, the global economy may be the greatest illusionary trick ever pulled over the eyes of people around the world.

Who Owns the World?: Blackrock and Vanguard

|

|

StakeHolder capitalism - the enemy of humanity

The religion of capital;

the owners of Vanguard are among the 0.001% richest people on the planet with over $5 trillion in assets under management, is the largest provider of mutual funds and

second largest provider of exchange-traded funds in the world after BlackRock"s iShares

This is their aim:

(1) Conservation of Capital,

(2) Reasonable Current Income, and

(3) Profits Without Undue Risk.

John Bogle -

Reflections on Wellington Fund"s 75th Birthday - From an Investor and Crewmember for 53 years,

and a Chairman for 27 Years

The Wellington Fund was the first balanced mutual fund in the United States, and is one of the oldest surviving mutual funds. It was established in 1928 by Walter L. Morgan with $100,000 raised from relatives and business people in Morgan's home state of Pennsylvania.

It was originally called the Industrial and Power Securities Company, but was later renamed after the Duke of Wellington.

Wellington Management Company was incorporated in 1933, and while it still manages the Wellington Fund, it is a private firm, independent of Vanguard.

The Hidden hand? eh?

Both Vanguard & Wellington buisnesses are named in Honor of something: what could it be?

and does this point to the real power behind all of it?

|

|

Ahoy shipmates!

oooh swish!

|

Vanguard - The model for Stakeholder Captialism

John Bogle is without question a titan of our age. He founded the investor-owned, ultra-cost-conscious Vanguard Group and built it into the second-largest mutual fund company in the land. He pioneered index mutual funds and was a leading force behind the triumph of no-load investing. He has written bestselling books of investment advice. His opinions are regularly sought by journalists and elected officials. He even spawned an army of "Bogleheads," small investors from around the country who communicate their admiration for the man on Internet message boards and gather for occasional jamborees.

(snip)

Bogle dubbed his rump organization Vanguard, after Nelson's flagship at the Battle of the Nile--thus keeping with the Napoleonic-wars theme set by "Wellington." And while Vanguard was at first in charge of nothing but keeping records and sending out statements to shareholders, Bogle quickly devised some sneaky ways to extend its reach. He got around the distribution compromise by switching the funds to no-load--selling shares directly without an up-front fee instead of going through the brokers controlled by Wellington. Then, in 1976, came the Vanguard Index Trust, which, because it simply aimed to track the S&P 500, got around the boards' decision to leave money "management" in the hands of Wellington. (Wellington Management is still around and still manages some Vanguard funds. But not many.) "It was one of the great acts of disingenuous opportunism defined by the mind of man," Bogle says now.

Thus was Vanguard, the only major mutual fund company controlled by the shareholders in its mutual funds, born. And thus was John Bogle reborn as a fearless crusader for small investors. If the Bostonians hadn't fired him, it might never have happened. "If I were still running Wellington Management, it wouldn't be no-load, and I would probably be rich as Croesus," Bogle says.

(snip)

"The last time Vanguard's founder was invited to speak at an ICI event was in 1990, when another fund executive referred to him in a speech as not just a communist but a Bolshevik. Bogle responded that most of the people who worked for him considered him a fascist"

|

Uber-Capitalist Syndicalism?

Corporatism / guilds / mercantile elites

National syndicalism is a far-right adaptation of syndicalism to suit the broader agenda of integral nationalism. National syndicalism developed in France, and then spread to Italy, Spain, and Portugal.

Wikipedia

Although the corporate idea was intimated in the congregationalism of colonial Puritan New England and in mercantilism, its earliest theoretical expression did not appear until after the French Revolution (1789) and was strongest in eastern Germany and Austria. The chief spokesman for this corporatism—or "distributism," as it was later called in Germany—was Adam Müller, the court philosopher for Prince Klemens Metternich. Müller"s attacks on French egalitarianism and on the laissez-faire economics of the Scottish political economist Adam Smith were vigorous attempts to find a modern justification for traditional institutions and led him to conceive of a modernized Ständestaat ("class state"), which might claim sovereignty and divine right because it would be organized to regulate production and coordinate class interests. Although roughly equivalent to the feudal classes, its Stände ("estates") were to operate as guilds, or corporations, each controlling a specific function of social life. Müller"s theories were buried with Metternich, but after the end of the 19th century they gained in popularity. In Europe his ideas served movements analogous to guild socialism, which flourished in England and had many features in common with corporatism, though its sources and aims were largely secular. In France, Germany, Austria, and Italy, supporters of Christian syndicalism revived the theory of corporations in order to combat the revolutionary syndicalists on the one hand and the socialist political parties on the other. The most systematic expositions of the theory were by the Austrian economist Othmar Spann and the Italian leader of Christian democracy Giuseppe Toniolo.

The link between guilds and confraternities, in early-modern France, requires mixing both temporal and spiritual aspects of a corporated economy at that time. The example of Paris, featuring great merchant guilds, adds another dimension, that is their supporting role to an ever smaller group, les notables, and to their social and economical interest. The very existence of the confraternity as a separate community, even as a place of integration for all the members, can thus be questioned. Over the 18th century, confraternity appeared to become but a expenditure item, that guild"s chiefs controlled by their own (as payment of alms and divine service costs). It is coupled too with a process of monetarisation and pricing practices affecting all internal relationships. The more this process was developing, the more the monarchy could oversee it, inspect it, and at last condemn it as a wide set of bad accounting policies. Confraternity was then dissolved in a powerful conception of temporal and public authority, handled by a more and more administrative monarchy, by its rules, announcing in such a way the abolition of the whole guild system by Turgot in 1776.

|

Researchers making the claim that Vanguard is gobbling up companies are missing the point of what stakeholder capitalism represents & is being pushed to become THE dominant force in global economics.

It is the Elite super rich who are owners of the very corporations themselves that actually own Vanguard - as stakeholders

As an example; This is the Vanguard directorship list from 2011:

EmersonU.Fullwood, VP of Xerox Corp;

JoAnn Heffernan Heisen, VP Johnson & Johnson,

Robert Wood Johnson;

Mark Loughridge, CFO of IBM,

Alfred M. Rankin Jr., CEO of NACCO Ind Inc.National Association of Manufacturers, Goodrich Corp, chair of FedRes Bank Cleveland

to give you an idea of the type of post industrial gentry class of the owners of planet earth:

a simple search online reveals the Ex-Owner of British Midland Airways, The former UK Channel 4 chairman & now Lifetime peer Lord Michael Bishop - is a stakeholder in both Vanguard & Blackrock - In 2001 he was worth $265million.

registered interests:

Lord Glendonbrook

Vanguard S&P 500 Ucits Etf Ie00B3Xxrp09

(developed market equities)

Blackrock European Dynamic Fund Shs -A- (Gbp) /Acc Gb0000495209

(developed market equities)

|

|

|

|

Yes it's him again!

|

WEF - Davos 2021

Speakers: Gillian R. Tett, Laurence D. Fink, Brian T. Moynihan, Chrystia Freeland, Marc Benioff, Kristalina Georgieva, Klaus Schwab

The World Economic Forum"s International Business Council has proposed a set of universal environmental, social and governance (ESG) metrics on which companies can report, regardless of their industry or region. This Leadership Panel examines how business leaders can implement non-financial disclosures for their companies and how investors and governments can work together to advance stakeholder capitalism in their region.

This video - even if only for it's introduction, is a perfect example of the type of PR exercise that, after knowing what these fascists are REALLY up to...induces a fair amount of nausea.

|

|

(excerpt from this CNBC report Aug 27 2021 )

Online brokerages generate profits when their customers trade more often. Robinhood Markets, for example, makes money in part by sending its customers" orders to high-frequency traders in exchange for cash. That process is itself controversial and known on Wall Street as payment for order flow.

But if game-like prompts or congratulatory messages from online brokerages cause customers to make more trades — and especially if more trades result in poorer portfolio performance at slightly worse prices — should the SEC intervene?

Gensler"s second key question is a bit more cerebral.

In essence, the SEC wants to answer: If brokerages" game-like or predictive prompts assume optimal outcomes and impact how often customers trade, should the regulator consider those in-app prompts as formal investment recommendations or investment advice?

|

|

Suddenly Vanguard, BlackRock, State Street not only have the assets but the power of ESG mandates, which make them a growing threat to shareholder democracy, critics say (intro)

A handful of super-charged fund managers control $34 trillion of assets and most of the ESG inflows, giving them 'carte blanche' to shape corporate policies.

July 29, 2021by Oisin Breen

The embrace of ESG by an ETF power bloc of BlackRock, Vanguard Group, Fidelity Investments, Capital Group and State Street may augur a dark future where they hold the power to sway shareholder votes, according to RIAs, fund trackers, hedge funds and ESG advocates alike.

The rising chorus of critics say the elite exchange-traded-fund producers from Boston, New York, Philly and Los Angeles pose a rising threat to "shareholder democracy" -- albeit because the power has been thrust upon them.

Investors and advisors have not only funneled their assets to the ETF elite for the past decade but also made them all powerful by giving carte blanche to deploy Environmental, Social and Governance (ESG) filters that would freeze out scores of companies.

But now American investors need to be careful about what they asked for, says Vincent Deluard, global macro strategist at New York City brokerage, StoneX.

"It doesn't matter whether it's Vanguard, BlackRock, Fidelity or the California Public Employees Retirement System; if two or three investors control 20% to 40% of the vote of every US company, shareholder democracy will not work as intended," he says, via email.

Between them, the big five manage $27.7 trillion in client assets globally, and administer over $34 trillion. In US equities alone, the grouping manages $15.07 trillion, or 61.89% of all assets held in US equity funds, according to Morningstar Direct.

|

Here"s one trader"s strategy for newly public game app Roblox

but here's the link to the

timestamp in this investigation via people make games

The Gamification Agenda

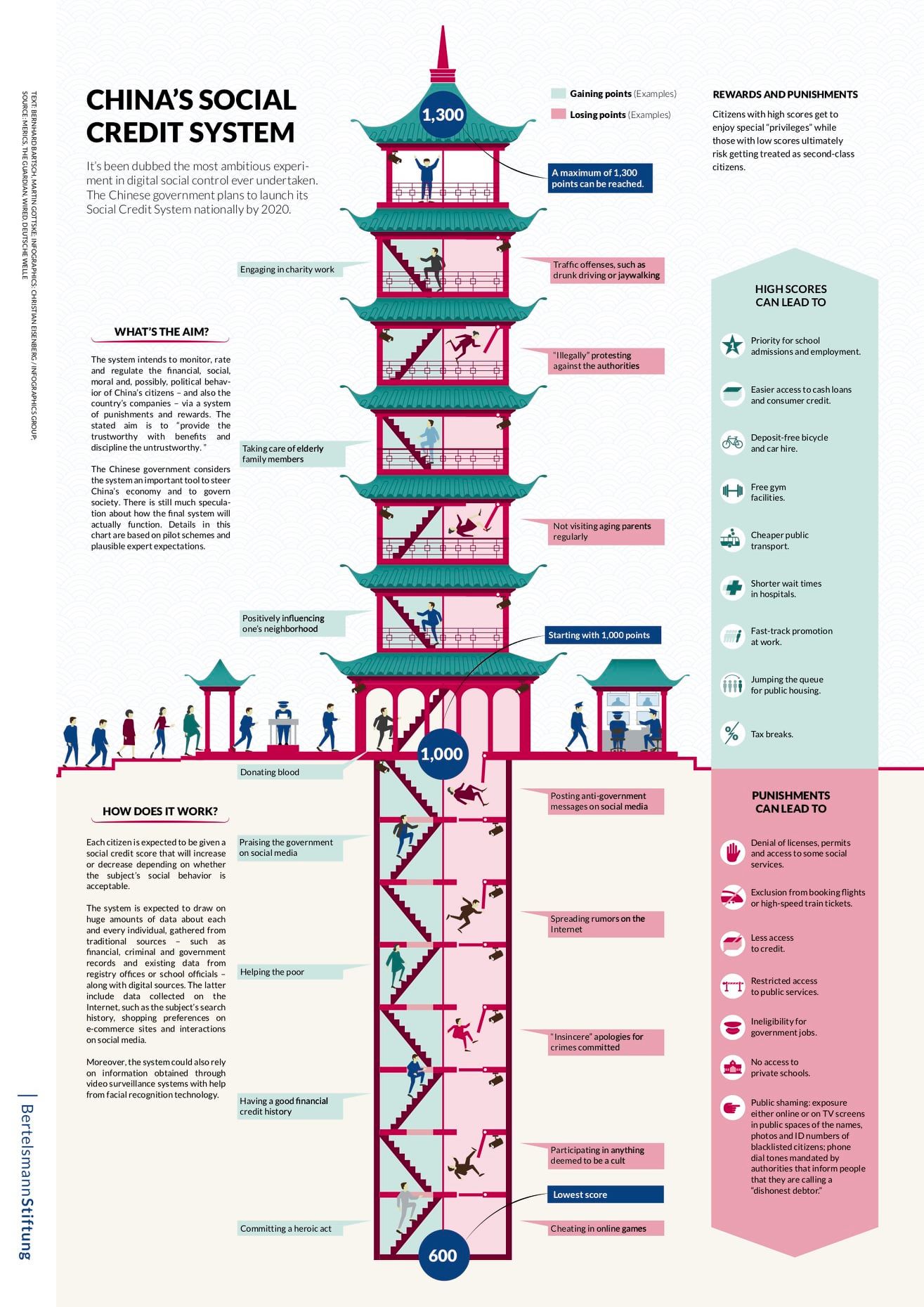

Baidu & Chinas Social Credit system - going back to 2017:

Inside China's Vast New Experiment in Social Ranking

China is taking the idea of a credit score to the extreme, using big data to track and rank what you do—your purchases, your pastimes, your mistakes.

(exceprted from Wired 2017 story )

It didn"t take long for the central government Leaders realized that "if we are going to have a market system that is supposed to be self-guiding, we also need to have self-guiding credit systems," says Rogier Creemers, a scholar of Chinese law at the Leiden Institute for Area Studies in the Netherlands. In the late 1990s, a working group at a Chinese Academy of Sciences institute developed the basic concepts behind the social credit system. But the technology wasn"t advanced enough to support the Communist Party"s broader political designs.

Nearly a decade ago, I spent a few weeks in Suining, a mostly rural county in Jiangsu province, near Shanghai. Back then, local governance was not subtle. When officials decided to clamp down on people running red lights, they urged citizens to take pictures of offenders, whose images would later be featured on the local television channel.

Then, in 2010, Suining became one of the first areas in China to pilot a social credit system. Officials there began assessing residents on a range of criteria, including education level, online behavior, and how well they followed traffic laws. Each of Suining"s 1.1 million citizens older than 14 started out with 1,000 points, and points were added or deducted based on behavior.

Taking care of elderly family members earned you 50 points. Helping the poor merited 10 points. Helping the poor in a way that was reported by the media: 15. A drunk driving conviction meant the loss of 50 points, as did bribing an official. After the points were tallied up, citizens were assigned grades of A, B, C, or D. Grade A citizens would be given priority for school admissions and employment, while D citizens would be denied licenses, permits, and access to some social services.

The Suining system was rudimentary, and it briefly sparked a national debate over what criteria should be included in a social credit score. But it provided a testing ground for what could work nationally. And however crude the letter grades were, they were less crude than what they replaced. Social credit in Suining was accompanied by a shift to subtler government messaging.

Since the Suining pilot, dozens of cities have developed their own systems. The power of technology had caught up. Eventually, these systems will be integrated into the nationwide government social credit system, which entails a significant logistical headache.To aid in the task, the government has enlisted Baidu, a big tech company, to help develop the social credit database by the 2020 deadline.

The Chinese tech companies have, in their way, helped to shift the Party"s attitude toward digital technologies. When the internet first came to China, bursting into people"s lives in the form of blogs and chat rooms, the Party saw it as a threat. Here was a place where people might speak their minds, join together, dissent. Leaders responded to these impulses through censorship and other aggressive tactics. But companies like Ant Financial have shown just how useful digital technologies can be in gathering and deploying information. Instead of merely reacting to content by banning search terms or shutting down websites, the government now collaborates with the private sector on facial and voice recognition technologies, along with artificial intelligence research.

In 2015, a few months after Zhima Credit debuted, Alibaba founder Jack Ma and 14 other executives traveled to the US with President Xi ÂJinping for his first state visit. Ma, along with leaders at Tencent and Baidu, also sits on the board of the Internet Society of China, a quasi-Âgovernmental organization under the direction of the Party.

This strategic nexus is a delicate one, though. In recent months Chinese regulators have taken steps to exert more control over tech companies. Last August, the People"s Bank of China ordered mobile and online payment companies to connect to a central government clearinghouse, giving regulators access to transaction data. Two months later, The Wall Street Journal reported that Chinese internet regulators were considering taking a 1 percent stake in the major tech companies.

One possible scenario for a social credit partnership is that the central bank will oversee the development of a broader metric, like a FICO score, while letting companies like Ant Financial collect data to feed into that score. Whatever its eventual structure, the larger social credit system "will definitely be under the government"s control," says You Xi, the reporter who wrote the book about Ant Financial. "The government doesn"t want this very important infrastructure of the people"s credit in one big company"s hands."

to start thinking about gamifying good behavior.

|

note what is at the bottom (worst) on the naughty list on the Social Credit graphic (above) - cheating in online games, also take note that this graphic was reproduced as part of it's series Asia in Infographics

by The Bertelsmann Group see PDF here - who are looking to become a leading force in cloud, data and artificial intelligence -

The Bertlemann Group have a linkage that runs deep into US /UK military radar with links historically to

|

|

|

China"s Social Credit System in 2021:

Key Findings

The Social Credit System is part of Xi Jinping's vision for data-driven governance. Government organs across regions and administrative levels should join hands to create a coherent information ecosystem. Data-sharing challenges continue to hamper this effort.

The Social Credit System is a highly flexible tool that can quickly be applied to address new policy priorities. During the Covid-19 pandemic, government agencies rapidly issued a slew of directives to implement pandemic-related regulations.

The flexibility of the system also comes at a cost: fragmentation. The Social Credit System is regulated by thousands of documents, but there is no clear definition of "credit" and substantial regional differences exist in implementation and evaluation standards.

The uneven implementation presents risks for individuals and companies alike. They have to navigate various regulations, lists and rating systems. There is an acute risk of "credit" becoming an arbitrary term that can be applied with disproportionate punishments.

The Chinese government is aware of these issues and has initiated steps to more clearly define "social credit", establish practises and improve measures for credit repair. Work on a Social Credit Law has started, but it may take years until core mechanisms become standardised nationwide.

The private tech sector continues to be excluded from the development of the official Social Credit System. But payment and consumer platforms like Alibaba"s Sesame Credit have created their own trust-rating initiatives.

The Social Credit System remains the least digitised of China"s tech-driven monitoring and surveillance initiatives. It relies heavily on human investigations, reports, and decisions. This also leaves room for traditional vectors of individual and political influence.

The party state will further build up, streamline and integrate digital monitoring and surveillance activities. More invasive domestic security platforms and initiatives have advanced rapidly and with significantly fewer limitations than the Social Credit System.

|

| 2017 - Alibaba Health Information Technology partners with Alipay

| 2020 - Alibaba Cloud, Fintech Academy & Pfizer Partner to Accelerate Healthcare Innovations across Asia Pacific

| 2021 - Pfizer partners with Alipay

|

.svg.png)

Alipay is a third-party mobile and online payment platform, established in Hangzhou, China in February 2004 by Alibaba Group and its founder Jack Ma. In 2015, Alipay moved its headquarters to Pudong, Shanghai, although its parent company Ant Financial remains Hangzhou-based.

Alipay overtook PayPal as the world's largest mobile payment platform in 2013.[2] As of 31 March 2018, the number of Alipay users reached 870 million. It is the world's number one mobile payment service organization and the second largest payment service organization in the world. According to the statistics of the fourth quarter of 2018, Alipay has a 55.32% share of the third-party payment market in mainland China, and it continues to grow. |

Pfizer Partnered With China"s ALIPAY

|

HSBC is the only Chinese interest here

|

|

Alibaba Group"s mission is to make it easy to do business anywhere.

We enable businesses to transform the way they market, sell and operate and improve their efficiencies. We provide the technology infrastructure and marketing reach to help merchants, brands, retailers and other businesses to leverage the power of new technology to engage with their users and customers and operate in a more efficient way.

Our businesses are comprised of China commerce, international commerce, Local Consumer Services, Cainiao, cloud, digital media and entertainment, and innovation initiatives and others. In addition, Ant Group, an unconsolidated related party, provides digital payment services and offers digital financial services to consumers and merchants and other businesses on our platforms. An ecosystem has developed around our platforms and businesses that consists of consumers, merchants, brands, retailers, third-party service providers, strategic alliance partners and other businesses.

|

|

|

Our Purpose

We"re in relentless pursuit of breakthroughs that change patients" lives. We innovate every day to make the world a healthier place. It was Charles Pfizer"s vision at the beginning and it holds true today.

|

|

|

About

Our mission is to make the complicated world simpler through technology. Founded in 2000 as a search engine platform, we were an early adopter of artificial intelligence in 2010 to make content discovery on the internet easier. We have also used "Baidu Brain," our core AI technology engine, to develop new AI businesses.

Today, Baidu is already a leading AI company with a strong Internet foundation. We are one of the very few companies in the world that offers a full AI stack, encompassing an infrastructure consists of AI chips, deep learning framework, core AI capabilities, such as natural language processing, knowledge graph, speech recognition, computer vision and augmented reality, as well as an open AI platform to facilitate wide application and use. We have put our leading AI capabilities into our products and services, as well as innovative use cases.

|

|

How accurate is the Wired 2017 story on Chinas Social Credit System...when it asserts:

"To aid in the task, the government has enlisted Baidu, a big tech company, to help develop the social credit database by the 2020 deadline." Is the assertion made by the Merics report a slight of hand?: "The private tech sector continues to be excluded from the development of the official Social Credit System.But payment and consumer platforms like Alibaba"s Sesame Credit have created their own trust-rating initiatives." |

|

Zhima Credit (pinyin: Zhima Xìnyòng),

also known as Sesame Credit, is a private credit scoring and loyalty program system

It uses data from Alibaba's services to compile its score.

Customers receive a score based on a variety of factors based on social media interactions and purchases carried out on Alibaba Group websites or paid for using its affiliate Ant Financial's Alipay mobile wallet.

The rewards of having a high score include easier access to loans from Ant Financial and having a more trustworthy profile on e-commerce sites within the Alibaba Group.

|

interesting results:

|

According to deal room here are a list of funding groups & investors

|

|

|

|

But it fails to note a MAJOR PLAYER - noted on the Crunchbase financial page for Ant Group

|

|

Vanguard Advice Select International Growth

James Anderson and Lawrence Burns of Baillie Gifford will comanage Vanguard Advice Select International Growth, but only for a little while. Anderson, who has excelled managing Baillie Gifford"s now 70% portion of Silver-rated Vanguard International Growth (VWILX) since 2003, will retire on April 30, 2022. While Burns lacks Anderson"s 40 years of industry experience, he is established. With Baillie Gifford since 2009, he joined its portfolio construction group of managers in 2012 and took over as deputy chair in 2019.

Baillie Gifford looks out up to 10 years and tries to identify emerging secular trends, such as the growth of Chinese consumerism, and then seeks the companies best positioned to capitalize on them. The team will hold on to these high-potential stocks even when they struggle, accepting failures with successes because in the long run the exponential compounding of spectacular winners should far exceed losers" setbacks.

Morningstar-A Sneak Peek at Vanguard"s High-Conviction Active Equity Funds for Advisory Clients

|

|

Chinese tech giant Baidu introduced a metaverse of virtual humans this week at Baidu Create 2021, in deliberate contrast to the presentation by Meta (formerly Facebook) CEO Mark Zuckerberg earlier this year. The digital world, named XiRang, is populated by humans and AI interacting through avatars built on the XiLing platform debuting in tandem with XiRang.

Metaverse XiRang

XiRang hosts a digital "Creator City" mimicking a physical city with original and recreated locales like the Shaolin Monastery. The virtual world is accessible through an app on computers and smartphones or with Pico virtual reality headsets. Baidu hosted CEO Robin Li and other executives at an AI conference within XiRang this week. Users with a Baidu service account can register on the app and build an avatar to travel around the virtual world, interacting with others by pointing their avatar at another and talking. XiRang, which means ‘land of hope," can support up to 100,000 users at a time right now, which Baidu emphasized because its metaverse is still under development.

|

|

According to Baidu CEO Robin Li, the metaverse will kick off a "golden era of AI over the next ten years" and the start of "man-computer symbiosis," which will change the world. Li claims Baidu has more than a million employees working on AI and plans to quintuple that number in the next five years. "Creators are our companions in pursuing our dreams of technology, they are also one of the great driving forces of human progress," Li said.

XiLing Virtual Human

XiLing is Baidu"s platform for building digital avatars with artificial intelligence to use in a variety of media. Baidu described it as a tool for designing the virtual spokesperson for audio and video advertisements, social media posts and as a host, not unlike the virtual human built by Sber to host a Russian television show. The enterprise value of virtual humans has risen rapidly over the last few years, and new and improved virtual human tools and creations appear all the time.

|

Social credit report 2021 - It's definitely happening!

SocialCredit Market by Physical and Cyber Infrastructure

Select Report Findings:

Cameras and other optical equipment for social credit systems will reach $723M globally by 2026

Advanced computing will be used in conjunction with AI to provide nearly flawless identification and tracking

Various forms of biometrics will be used for identity verification as well as verifying the presence/location of people

Starting as tangential to public safety and homeland security, the social credit market becomes mainstream by 2026

Social credit systems represent the ability to identify (mostly people but also some “things”) and track activities for purposes of grading behaviors and applying “social credit” scoring. A given grading/scoring methodology depends largely on social credit system objectives and metrics.

However, most systems will have socially acceptable behaviour at their core. This presents both a challenge and an opportunity as a combination of government, companies, and society as a whole must determine “good”, “bad”, and “marginal” behavior within the social credit market.

Beginning as a trend largely orthogonal to public safety and homeland security concerns, the market for social credit system infrastructure will ultimately become a mainstream component of both business and public policy.

This means that systems will ultimately be used for a variety of commerce and lifestyle-related issues ranging from risk assessment (access to credit, financing fees, insurance, etc.) to accessibility within public places such as concerts, sporting events, and other assemblies. High social scoring individuals within the social credit market will be granted preferred access to both real and digital assets.

Social credit system infrastructure includes analogue and digital surveillance, Internet-enabled devices like smartphones, wearable devices, security systems, sensor-enabled physical objects, and surveillance devices that use biometrics and computer vision. Technologies include broadband wireless (WiFi, LTE, and 5G), IoT, AI algorithms, and big data analytics platforms, processes, and procedures.

While each of these systems has market value individually, and are deployed separately for various purposes, it is the convergence of these otherwise disparate technologies that will facilitate value within the social credit market. For example, combined AI and IoT systems will be leveraged to identify important events that require immediate action versus those that are merely archived.

It is important to note that there is great overlap between the technologies used for social credit systems and other solutions such as public safety, homeland security, and smart cities applications of many types including smart transportation (highways and surface streets, parking, autonomous vehicles, etc.), intelligent buildings, environmental monitoring (light, temperature, pressure, etc.). Many of these infrastructure elements are already planned for smart city implementations and will, therefore, be multi-purposed including support of the social credit market.

In terms of physical infrastructure, social credit systems will rely upon various forms of equipment and platforms including sensors, biometrics, cameras, and other optical devices, computer vision systems, and other advanced computing platforms.

Cyberinfrastructure includes platforms, devices, and software to support data processing and correlation with identity information, which shall leverage AI, IoT, and advanced data analytics. The main purpose for all the aforementioned infrastructure elements is to capture data, which must be stored and acted upon as appropriate.

At the heart of social credit, systems are large-scale data repositories that may store virtually any type of data that may be correlated to or associated with citizens and businesses in terms of both identity and behaviors.

This includes raw observational data as well as listings (white, grey, red, and black) and meta-data to tie together data elements and allow for ease of information queries. Without the use of AI and big data technology, it would be problematic to implement social credit market systems in a meaningful way as massive amounts of disparate data must be correlated.

(Sensors, Cameras,Biometrics, Computer Vision),

Software (Machine Learning, Data Analytics,APIs),

Use Cases, Applications, Industry Verticals, and Regions 2021 – 2026

The COVID-19 pandemic has facilitated substantial interest in citizen monitoring solutions

Infrastructure to support social credit systems represents a $16.1B global opportunity by 2026